8 things you should shred right away

Most papers can be touched once, and then tossed in the garbage like a hamburger wrapper. Yet we all have some valuable identification records, financial statements, contracts or receipts that we ought to file and store in a safe place for easy retrieval later on.

Any victim of identity theft, fire, or flood will be glad for the time taken in advance to file and store critical records. And, if you’ve ever had to settle the estate of a friend or loved one, you’ll be relieved if you find official records in one, organized location.

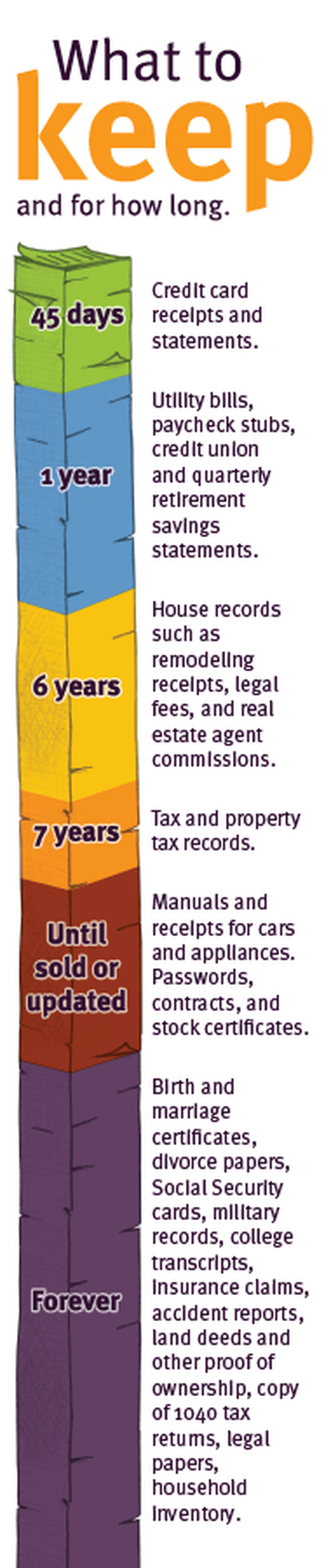

Here’s a quick guide to evaluate what records you should keep — and for how long — when sorting through the growing amount of paperwork arriving each year:

• Seven years: Keep state and federal tax records and receipts for seven years, saving a copy of your 1040 tax return forever.

• Six years: Keep documents showing home sale, purchase, or expenses for improvements for six years after you sell your home.

• Three years: Retain those thank-you letters from charities, and also year-end investment statements, in the event you are audited by the IRS.

• One year or less: Pay stubs and bank statements; annually updated Social Security statements; annual insurance policy statements; annual retirement plan statements (401(k), 529, IRA, etc.); bank deposit and ATM receipts until reconciled with your monthly statements; credit card bills and statements (longer if needed as proof of a charitable contribution or product warranty); and utility bills.

For a complete list of what documents to shred and when, as well as what documents you should always retain and storage tips, visit the STCU Money Blog. And mark your calendars for a free Shred Day on October 15, brought to you by STCU and KHQ!