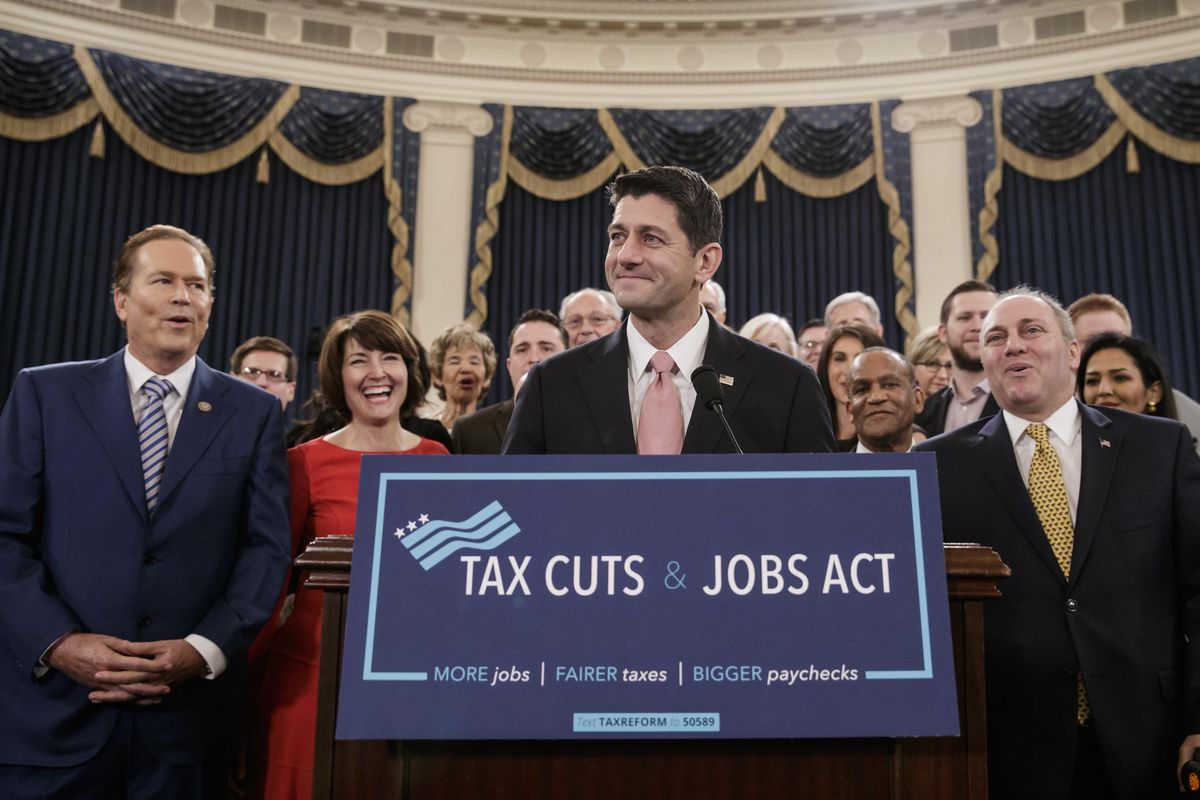

Tax plan good for everyone, McMorris Rodgers says; mostly for the rich, Democrats contend

The House Republican tax overhaul would result in Eastern Washington residents paying less in taxes while seeing wages rise and more jobs, Rep. Cathy McMorris Rodgers said Thursday several hours after the plan was released.

“This is tax relief for everyone,” McMorris Rodgers, the fourth-ranking Republican in the House, said in a phone interview.

Some Washington Democrats strongly disagreed, saying it would do away with deductions middle-class families use and would mainly help the wealthy.

“This is a massive tax cut for the rich, and nobody should expect those tax breaks to ‘trickle down,’ ” said Democrat Patty Murray, a member of the Senate Budget Committee.

Murray and Gov. Jay Inslee were critical of the proposed elimination of the deduction that taxpayers who itemize can take for state and local sales taxes they pay, which in Washington involves the state’s high sales tax. For years, members of the state congressional delegation from both parties fought to make the sales tax deduction permanent, on par with state income taxes. That passed in December 2015.

It’s a way of taking money away from workers “to line the pockets of billionaires and large corporations,” Murray said in a video released by her staff.

McMorris Rodgers said the middle class would benefit from lower rates in most cases, higher child tax credits and the proposed increase in the standard deduction, a near doubling from $6,350 to $12,000 for an individual or twice that for a husband and wife filing jointly. That would mean fewer middle-class families will need to itemize deductions, but those who do would still be able to claim up to $10,000 in property tax payments.

“People in Eastern Washington are going to pay less, overall,” she said, adding that the state is one of the least affected by the proposed elimination of the state and local tax deduction.

Although charitable contributions will still be deductible, some charities fear reducing the number of people who itemize deductions could lead to a drop in donations. McMorris Rodgers countered that cutting taxes would give people “more money in their pockets to give” and she’s talking with charities on ways to incentivize donors.

The House Republican tax proposal would boost the economy, she said, lowering corporate tax rates from the current 35 percent to 20 percent. “We have the highest corporate tax rate of any country in the developed world,” she said.

Critics point out that because of the many deductions, few large corporations pay that 35 percent. But McMorris Rodgers said that along with reducing the rate, House Republicans propose making “a long list of deductions and loopholes go away” for big corporations. Whether a company would pay more or less under the new proposal depends on the industry, she said.

That lower corporate tax rate would mean small businesses would have the lowest tax rate since before World War II, she said. But the National Federation of Independent Business, a major lobbying group, said the way the rates are structured means many small businesses won’t qualify for a lower rate, and some personal service businesses wouldn’t be eligible.

In all, the proposed cuts could add an extra $1.5 trillion to the projected deficit over 10 years. If it increases jobs and wages, the growing economy could provide more revenue, McMorris Rodgers said. Part of reducing the deficit is “tightening our belts and making tough decisions,” she added.

The Ways and Means Committee will begin looking at possible changes to the GOP tax plan on Monday, with a goal of a version passing the House by Thanksgiving and a final bill passing Congress by Christmas.

Rep. Suzan DelBene, a Washington Democrat on that committee, criticized the time table and what she called a partisan GOP plan “cooked up behind closed doors.” The last time a major tax revision passed Congress in 1986, it was the result of a yearlong review and 30 days of public hearings, she said.

Republicans should work with Democrats on something that will affect all Americans, DelBene said.

McMorris Rodgers argued that bipartisan groups have looked at tax law for years and Democrats should get behind the parts of this plan they can support. Asked if amendments in the coming weeks could add or subtract anything that would make her drop support for the plan, she said: “I’m not drawing any lines in the sand.”