Who owns Avista? Home-grown utility owned by large, institutional investors

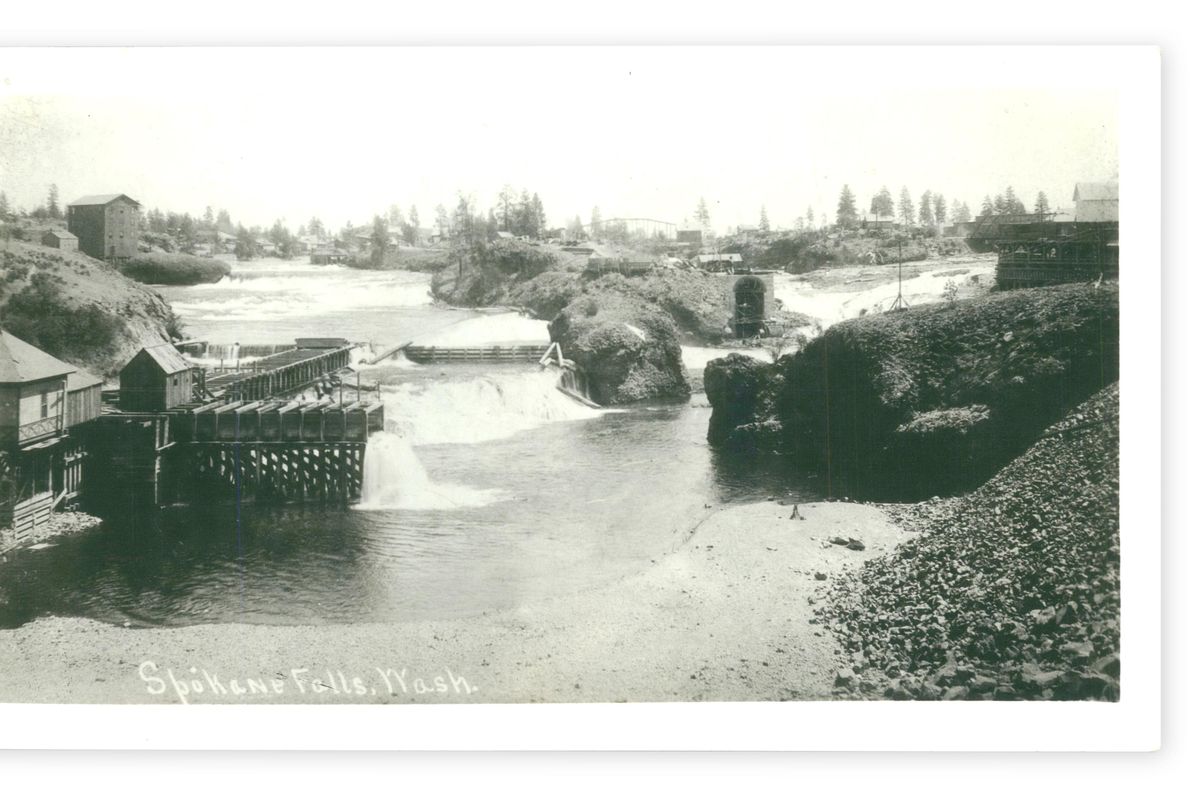

Avista Corp. is Spokane’s homegrown utility, founded in 1889 to supply electricity to a frontier town.

When East Coast investors spurned the opportunity to finance dam development on the lower falls of the Spokane River, a group of local investors raised the money themselves.

Avista – formerly known as Washington Water Power – still has a hometown company image. But the company’s stock ownership has long since moved outside the region.

On Nov. 21, Avista shareholders will vote on whether to approve the company’s sale to Hydro One, an Ontario utility. Most of the ballots will be cast by large, institutional investors poised to earn a tidy profit when the sale is final.

Hydro One is offering $53 for each share of Avista stock, which represents a 20 percent premium over the company’s closing price on July 19, when the proposed sale was announced.

The shift in Avista’s stock ownership reflects trends in U.S. investing, said Mark Thies, Avista’s senior vice president and chief financial officer. Direct stock ownership has declined as mutual funds, hedge funds, 401(k) retirement plans and IRAs have increased in popularity.

People “still may have a lot of Avista stock,” Thies said. But if it’s part of an energy mutual fund offered through their 401(k) plan, they probably don’t realize it, he said.

Avista’s largest shareholders are BlackRock Inc. and Vanguard Group. “They’re really index funds for mutual funds,” Thies said.

BlackRock controls 18 percent of Avista’s stock, or about 11.6 million shares, according to a Bloomberg analysis. Vanguard controls nearly 10 percent, or 6.3 million shares.

Avista’s decision to cut dividends in the late 1990s also may have influenced individual stock ownership. The company went from paying annual stock dividends of $1.24 per share to 48 cents per share in a strategic move to focus on growth.

At the time, some brokers told clients who held Avista stock for dividend income to sell it.