This column reflects the opinion of the writer. Learn about the differences between a news story and an opinion column.

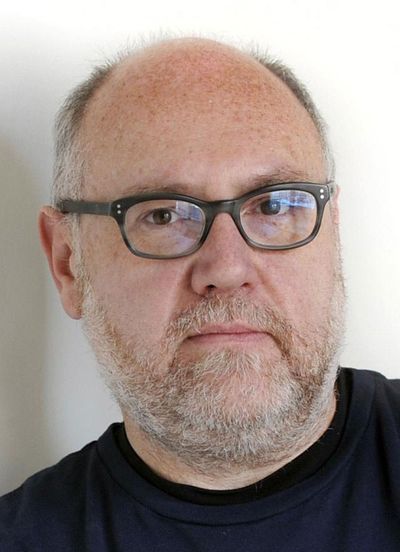

Shawn Vestal: For college students, Pell grants aren’t what they used to be

A million years ago, I paid for college with Pell Grants and dishwashing and a wee little student loan.

Back then, the Pell Grant – the federal assistance for kids from poor families – covered a substantial part of the bill. While I can’t recall my own budget breakdown between tuition, books and beer, I know that the grants were my lifeline, the boost that made it possible for me to attend the University of Idaho. I supplemented it by working, and I earned some scholarships, but those weren’t my main support.

The Pell Grant was the chief way poor kids could get a higher education, and a key way the country kept its promises about the equality of opportunity. But as a new school year starts on campuses everywhere, we take another step downward in the slow-motion breaking of that promise: The costs of college are rising crazily; the bulk of the increases fall squarely on students and families; and the purchasing power of the Pell Grant shrinks faster every year.

In the past four decades, the value of the maximum Pell Grant against the cost of college has plummeted. According to the United Negro College Fund, the maximum grant in the 1976-77 school year covered 72 percent of costs at public four-year universities.

By 2015-16, it covered less than a third of those costs.

The picture at private colleges is even worse, falling from covering 35 percent of costs to 13 percent over the same time period.

Meanwhile, college debt now represents the second-largest category of indebtness in the nation, behind automobiles and ahead of credit cards. The average college borrower could buy a really nice car – or put a down payment on a home – with the principal and interest they now spend years repaying.

The average graduate of college in 2017 who borrowed to finance their education now carries almost $40,000 in debt. (Seventy percent of all students borrow.) That was a 6 percent increase from the previous year, according to federal statistics compiled by the website Student Loan Hero.

These figures are lower in our region – the typical Washington college grad who borrows has almost $25,000 in debt, and in Idaho it’s now over $26,000, according to the Institute for College Access and Success. Washington’s figure is pushed downward, no doubt, by significant tuition cuts in 2015, which were driven in large part by Sen. Michael Baumgartner, who pressed repeatedly for measures to lower costs on college students.

All told, 44 million Americans now owe $1.5 trillion in student loan debt. The average borrower aged 20-30 has a monthly payment of $351; the median payment is $203.

Year after year, these figures go up. Between 1990 and 2012, according to the Pew Research Center, the amount of money loaned for college increased 352 percent – a figure that has only risen in the years since, and which is growing even faster than the rapidly rising cost of college itself. The annual inflation rate over the past decade at colleges nationwide has been 5 percent a year.

Boil it all down and it looks suspiciously like a three-point plan an evil villain concocted to hamper young adults:

1) Make college way, way more expensive.

2) Reduce financial support for students and institutions.

3) Rush in with loan application forms and set the interest rates.

The program we now call the Pell Grant is a relic of a different time, economically and philosophically. It was created in 1965, and has undergone several changes since, including being renamed in honor of Sen. Claiborne Pell; low-income students are given grants on how much their family can contribute.

The maximum for 2018-19, according to the current federal charts, is $6,095.

In constant dollars, it’s actually smaller than it was in 1976-77.

A country that was serious about making college accessible to everyone would be looking aggressively for ways to make college more affordable, and would invest in doing so. And yet earlier this year the Trump administration proposed massive cuts to student assistance, and a freeze on Pell Grants, when it was trying to pretend its tax cuts were going to be paid for.

Meanwhile, the days when a poor kid could afford to send himself to public college without mortgaging his future fade further from memory every year.