Ad watch: Ephrata group targets McMorris Rodgers, Newhouse with questionable claims about taxes, veterans

A political action committee formed in Ephrata, Washington, that is pushing for impeachment of President Donald Trump has taken aim at U.S. Rep. Cathy McMorris Rodgers with some dubious claims about funding for veterans and taxes.

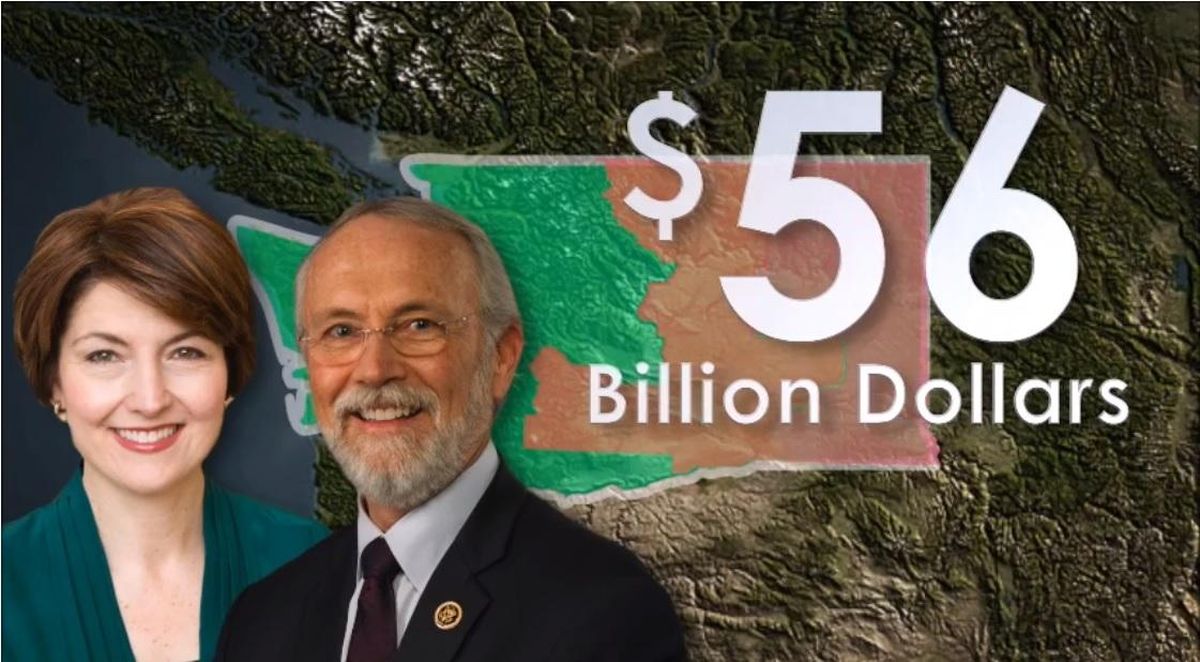

Question PAC was formed in April by bookkeeper Charlie Wiegand, who kickstarted its work with $10,000 of his own cash. The group has produced several ad spots targeting the congresswoman and Rep. Dan Newhouse, whose Central Washington district includes Yakima, the Tri-Cities and Okanogan. One of those ads suggests the Republican lawmakers are in favor of vast spending cuts to the Department of Veterans Affairs and that federal tax reform legislation increased the deficit “by funneling money into international corporate entities.”

Those claims simplify the intent of legislation the congresswoman introduced in what she says is an effort to increase congressional oversight on spending. They also inflate the effect of the federal tax bill on corporations.

Wiegand previously worked in audio and visual production. He said his intention with the ads, which haven’t yet aired on traditional broadcast outlets, is to get the public talking about issues he believes have been overlooked by traditional media in the district. The videos are being shared on social media by political groups supporting Democrat Lisa Brown in Eastern Washington’s race for the 5th District Congressional seat.

“We would love to do traditional, regional television and radio,” Wiegand said. “Right now we are just getting our name out there.”

So far, financial reports filed with the Federal Election Commission and Washington Public Disclosure Commission show just Wiegand’s investments in the action committee, which is filed as a nonprofit organization that can receive limitless political contributions because it doesn’t work directly with a campaign. That’s the same designation given to so-called “super PACs” that aren’t required to disclose donors, though Wiegand says he’ll turn over the information of those giving to the group.

“All of our donors will be disclosed in both state and federal election filings,” Wiegand said.

McMorris Rodgers finished ahead of Brown in the August primary for Eastern Washington’s seat. Newhouse, who was first elected in 2015 to replace outgoing Rep. Doc Hastings, finished with 63 percent of the vote over Democrat Christine Brown in his primary.

The ad indicates McMorris Rodgers and Newhouse support putting “$56 billion in veteran’s spending on the chopping block.” Wiegand said the source of that claim is McMorris Rodgers’ introduction of the “Unauthorized Spending Authorization Act,” a bill designed to require Congress to approve certain types of spending that have been automatically carried over in previous budget cycles, without lawmakers weighing in.

McMorris Rodgers has argued that such a process removes Congress’ “power of the purse” and has led to what she calls “autopilot” spending on programs. The bill doesn’t mandate cuts for those programs. It creates a three-year window for Congress to review such spending before funding automatically expires.

“It creates an incentive for Congress to do its job,” said Jared Powell, a spokesman for McMorris Rodgers.

But Wiegand had a less optimistic outlook on the legislation.

“They’re going to have to be very proactive, which they don’t have a reputation for being right now,” he said.

The $56 billion figure for veterans programs comes from a 2015 Congressional Budget Office report on how much spending automatically occurred that year without action from Congress. The total amount was $293 billion, with Veterans Affairs spending making up the largest portion of the total. The report notes that a vast majority of the unauthorized spending for Veterans Affairs programs covers hospital stays and other medical care for veterans who were disabled as a result of their service, holdovers from a 1996 law that laid out spending limits only for the first two years of the program. Cuts to those types of programs would be politically difficult to make, and Powell emphasized that the congresswoman’s intention is not to suggest all funding should end, just that it be reviewed.

“It’s not all bad spending,” he said.

The criticism from the PAC recalls a false claim that Democrat Joe Pakootas made in a debate against McMorris Rodgers two years ago, that funding for the department had been cut during the congresswoman’s tenure in the House of Representatives. Authorized spending for the VA has more-than doubled since 2005, her first year in Congress, from $79 billion to $185 billion in this year’s spending bill. Congress also just approved a defense spending bill that gives armed service members a 2.6 percent pay increase this year.

The ad’s other claim attacks the Republican tax reform legislation, linking McMorris Rodgers’ efforts to reduce spending to that legislation’s potential effect on the federal deficit. In a voiceover, the ad claims the lawmakers voted to “explode (the deficit) by $2 trillion by funneling money into international corporate entities.”

Wiegand defended the claim, stating the tax bill reduced the corporate tax rate for a longer period than individual tax cuts and that it continued to incentivize companies to keep assets in offshore accounts. He said the $2 trillion figure was the estimate of how much the federal deficit would grow as a result of the tax cuts.

“They exploded the debt by that much,” Wiegand said.

But the largest portion of lost tax revenue over the next decade will come from individuals, not businesses. A December 2017 analysis of the tax bill by the Congressional Budget Office put the legislation’s net effect at the deficit at $1.5 trillion over the next 10 years, not $2 trillion. The corporate rate cut accounted for $644 billion of that total, with individual rate slashing reducing revenue by more than twice that amount, $1.3 trillion. That amounts to $1.9 trillion in lost revenue, but that amount doesn’t include planned reductions in federal spending and payments of so-called “transition taxes” by companies that had previously used legal exemption to avoid paying certain taxes on foreign income.

In other words, the full amount of the tax cuts for American businesses with off-shore holdings is a portion of that $644 billion in corporate rate reductions than the full $1.5 trillion in deficit increases. Also, the claim assumes every corporation that received a tax cut has international holdings, which isn’t true.

Wiegand admitted this in an interview, saying the ad might need “an asterisk.” But he said his point – that the tax cuts benefitted businesses more than individuals – was valid. The off-shore tax rate on cash and noncash earnings is lower for corporations than individual taxpayers under the new tax plan, and those rate cuts for individuals sunset in 2025.

Powell countered that the new tax law had led to a period of sustained economic growth, including a surge in gross domestic product. Republicans have also introduced legislation this week that would extend the tax cuts for individuals, a move that may ease concerns about corporate rates being the only permanent slashing but also leads to a higher anticipated growth in the deficit. Observers have shown doubts whether such legislation would get a vote before the midterm election.