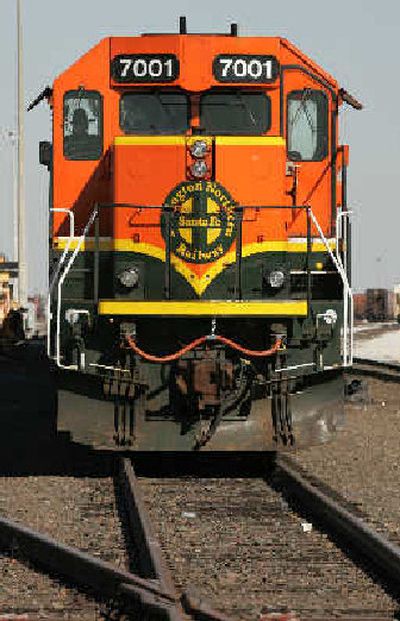

Volume gives BNSF a boost

Burlington Northern Santa Fe Corp., operator of the nation’s second-largest freight railroad, said Tuesday first-quarter profit gained as its trains carried more volume at higher prices, offsetting a spike in fuel costs.

The railroad said it earned $410 million, or $1.09 per share, compared to $321 million, or 83 cents per share, a year earlier.

Analysts had expected the Fort Worth-based company to earn $1.04 per share, according to Thomson Financial.

Burlington Northern said second-quarter earnings would rise 20 percent to 25 percent from a year ago and full-year earnings would increase 20 percent, greater than its previous forecast.

Still, Burlington shares fell $5.35, or 6.2 percent, to close at $81.49 on the New York Stock Exchange. Other rail stocks also dropped, and one analyst attributed the sell-off to profit-taking by investors who have enjoyed big gains in the stocks this year.

“Amazon.com Inc. said Tuesday that earnings fell nearly 35 percent in the first quarter, compared to a period last year in which the online retailer had a big one-time gain.

For the three months ending March 31, the Seattle-based company earned $51 million, or 12 cents per share, compared with $78 million, or 18 cents per share, in the same period a year ago.

In the year-earlier period, Amazon.com said it recorded a one-time gain of $26 million, or 6 cents per share, because of an accounting change.

Sales increased nearly 20 percent, to $2.28 billion, from $1.9 billion in the first quarter of 2005. The company said sales would have grown 25 percent if not for a $94 million impact from foreign exchange rates.

“Telecommunications equipment maker Lucent Technologies Inc. on Tuesday said declining Asian sales sent fiscal second-quarter earnings down 32 percent and reduced revenue by 8.4 percent. The company warned that it would have less revenue this year than last year.

Lucent, which agreed in March to be bought for $13.4 billion by France’s Alcatel SA, reported net income of $181 million, or 4 cents a share, for the three months ended March 31. That was a penny a share better than analysts expected, according to Thomson Financial.

Revenue slipped to $2.14 billion from $2.34 billion last year. Analysts surveyed by Thomson Financial had anticipated revenue of $2.24 billion.

“Northrop Grumman Corp. on Tuesday reported a 12 percent decline in first-quarter profit as revenues slipped from hurricane-ravaged ship operations, while fellow defense contractor Lockheed Martin saw its quarterly profit soar 60 percent.

Both companies beat Wall Street’s expectations, keeping with a generally positive outlook in the defense sector.

Lockheed Martin Corp., the nation’s largest supplier of military hardware and technology, reported net earnings of $591 million, or $1.34 per share, up from $369 million, or 83 cents per share, in the first quarter of 2005. Revenue stood at $9.2 billion.

Analysts surveyed by Thomson Financial, the majority factoring in accounting changes on stock options, predicted earnings of $1.14 per share. Revenue was forecast at $9 billion.

Northrop’s net income fell to $358 million, or $1.02 per share, from $409 million, or $1.11 per share, the year before.

“Martha Stewart Living Omnimedia Inc. reported a narrower loss in the first quarter as the media company enjoyed a 60 percent revenue gain driven by a continued rebound in advertising dollars.

The New York-based company on Tuesday posted a loss of $6.84 million, or 13 cents per share, in the three months ended March 31. That compares with a loss of $19.17 million, or 38 cents per share, in the year-ago period when the company’s namesake founder was finishing up a prison sentence for lying about a stock sale.