Vista delay hurts Microsoft

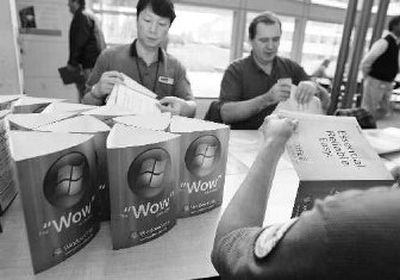

The long-delayed launch of the Windows Vista operating system cut into fiscal second-quarter profits at Microsoft Corp., which reported a 28 percent drop in earnings Thursday despite decent revenue growth.

In the last three months of the year, earnings fell to $2.63 billion, or 26 cents per share, from $3.65 billion, or 34 cents per share, during the same period last year.

Analysts polled by Thomson Financial expected the Redmond, Wash.-based software maker to post a profit of 23 cents per share.

Revenue rose to $12.5 billion, a 6 percent gain from $11.8 billion in the year-ago quarter. Analysts were expecting just shy of $12.1 billion in sales.

Microsoft shares fell 64 cents, 2.1 percent, to close Thursday at $30.45 on the Nasdaq Stock Market, ending an uneven day in which the stock also hit a 52-week high of $31.48. In extended trading after the earnings release, the stock was back up to $31.45.

Although Windows Vista and Office 2007, the latest editions of Microsoft’s flagship products, do not hit the consumer market until Tuesday, they have been available for businesses since Nov. 30, two-thirds of the way through the company’s second quarter.

Even so, Microsoft’s “client” division, responsible for Windows, posted a 25 percent drop in sales to $2.59 billion. And the business division, which includes Office, saw a 5 percent drop to $3.51 billion.

“Union Pacific Corp., the nation’s largest railroad operator, reported a 64 percent jump in fourth-quarter net income Thursday because of greater efficiencies and strong demand for the coal and agricultural products it ships.

The Omaha-based railroad said it earned $485 million, or $1.78 per share, during the quarter that ended Dec. 31. That’s up from last year’s $296 million, or $1.10 per share.

The result surpassed the expectations of analysts surveyed by Thomson Financial, who had forecast a profit of $1.57 per share.

Competitors Burlington Northern Santa Fe Corp. and CSX Corp. both reported strong jumps in fourth-quarter profits earlier this week and predicted good things in 2007. Burlington Northern’s earnings rose 21 percent in the fourth quarter, and CSX reported a 46 percent jump in net profit.

“Dow Chemical Co.‘s fourth-quarter profit declined 11 percent as higher costs offset a modest rise in sales, but its CEO said Thursday the performance by the world’s second-largest chemical company illustrates resiliency in a year of volatile energy prices and a challenging North American market.

Net income fell to $975 million, or $1 per share, in the last three months of 2006 from $1.1 billion, or $1.12 per share, in the year-ago period.

Dow said energy costs are trending lower in 2007 and expects to see healthy demand and “solid results” in the year ahead.

“Bristol-Myers Squibb Co. reported a loss for the fourth quarter on Thursday as sales of it best-selling drug Plavix plunged and it took a hefty charge to settle government investigations.

For the three months ended Dec. 31, Bristol-Myers lost $134 million, or 7 cents a share, compared with net income of $499 million, or 26 cents a share, a year earlier.

Excluding certain items, the drugmaker earned 19 cents a share, beating by 3 cents the consensus estimate of analysts surveyed by Thomson Financial.

Last August, generic drug manufacturer Apotex Inc. began selling a cheaper version of Plavix, a blood thinner Bristol-Myers co-markets with Sanofi-Aventis SA, after an agreement to settle a patent dispute fell apart. A judge issued an injunction forcing Apotex to stop selling the generic drug but it wasn’t required to recall what was already in the market.

“Defense contractors Lockheed Martin Corp. and Northrop Grumman Co. posted higher fourth-quarter earnings Thursday as government spending in areas like military hardware and information and technology remained strong.

Earnings for defense firms have risen steadily in recent years behind big spending increases on defense programs and equipment as the Pentagon fights wars in Afghanistan and Iraq. Many defense analysts expect that to continue when President Bush releases his 2008 budget and a supplemental spending request in the coming weeks.

For the fourth quarter of 2006, Lockheed’s net earnings rose 28 percent to $729 million, or $1.68 per share, compared with $568 million, or $1.29 per share in the year-ago period. The results included a 4 cent one-time gain. Analysts polled by Thomson Financial, who generally exclude one-time events, were looking for a profit of $1.46 per share.

Lockheed lowered its sales outlook to between $40.25 billion and $41.25 billion, down from its previous forecast of $41 billion to $42 billion, due to a change in accounting for the company’s new joint rocket launch venture with rival Boeing Co. Analysts expect 2007 revenue of $41.6 billion.