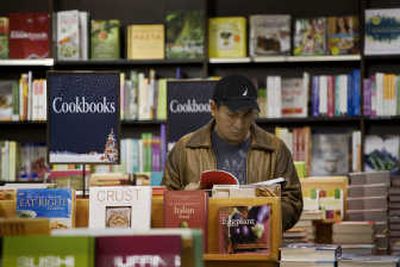

Earnings roundup: Bright outlook for book retailers

Barnes & Noble Inc. boosted its earnings outlook on Tuesday, after swinging to a third-quarter profit on sales of new releases. Its rival, Borders Group Inc., saw a loss widen in the same period, hurt by charges related to the sale of its United Kingdom and Ireland subsidiaries.

Still, the holiday outlook appeared brighter for both booksellers as the official start begins Friday. Borders, which has benefited from enhanced product assortments, said late Tuesday that it achieved same-store sales growth across all three businesses, the first time it has done so since the first quarter of 2004. The company also expects further improvement in the fourth quarter. Same-store sales are sales at stores opened at least a year and are considered a key barometer of a retailer’s health.

The New York-based Barnes & Noble recorded a profit of $4.38 million, or 7 cents per share, for the three months ended Nov. 3. That compared to a $2.77 million loss, or 4 cents per share in the year-ago period.

The company recorded a 5.7 percent increase in sales to $1.2 billion, from $1.11 billion in the year-ago period.

Shares rose $3.35 to $35.97 in afternoon trading.

Borders reported a net loss of $161.1 million, or $2.74 per share, in the three months ended Nov. 3. That was after a net loss of $39.1 million, or 64 cents per share, in the prior-year quarter.

Discount retailer Target Corp. said Tuesday that third-quarter earnings dipped 4 percent, missing Wall Street forecasts, because of weak sales in high-margin categories such as clothing and home furnishings.

Target also said its board has authorized a new $10 billion share buyback program that at current prices would cover 20 percent of its outstanding shares. Target said the buyback would be funded partially by additional debt.

Target shares fell $2.21, or 4.1 percent, to $51.69 Tuesday after trading at a 52-week low of $50.25 earlier in the session.

Third-quarter earnings fell to $483 million, or 56 cents per share, from $506 million, or 59 cents per share, in the prior year.

Quarterly sales grew 9 percent to $14.84 billion, from $13.57 billion in the third quarter of 2006.

Zale Corp. reported wider first-quarter losses Tuesday as the jewelry retailer cut its earnings outlook and issued a subdued holiday sales forecast.

Zale’s shares fell 65 cents, or 3.3 percent, to $19.28 in morning trading.

The company’s results in the latest quarter were hurt by losses at the Bailey Banks & Biddle chain, which it is selling, and the way it recognizes revenue from jewelry warranties.

Analysts have cautioned that midlevel jewelry chains like Zale’s could be vulnerable as consumers pay more for gasoline and cut back on discretionary spending. Other retailers, including Wal-Mart Stores Inc. and J.C. Penney Co., have given downbeat previews for the holiday season.

Chief Executive Mary E. “Betsy” Burton said Zale’s U.S. mall-based chains, which include Zales Jewelers, have been hurt by a decline in mall traffic and competition for shoppers.

“You’re fighting for dollars with the iPods and the flat-screen” televisions, she said.

Zale said it lost $28.4 million, or 58 cents per share, in the quarter ended Oct. 31, compared with a loss of $26.4 million, or 55 cents per share, a year earlier. The latest results included a loss of $1.7 million, or 4 cents per share, from Bailey Banks & Biddle.

Office Depot Inc., the nation’s second biggest office-supply store chain, said Tuesday its third-quarter profit fell 9 percent, hurt by lower consumer spending, a weak housing market and a British economic slowdown. Its shares fell more than 6 percent.

Net income fell to $117.5 million, or 43 cents per share, in the three months ended Sept. 29 from $129.1 million, or 45 cents per share, in the year-ago quarter. The latest period includes a $33 million tax benefit.

Sales climbed 2 percent to $3.94 billion from $3.86 billion in the prior-year period.