Bush submits $3.1 trillion plan

WASHINGTON – President Bush took office in 2001 with a budget surplus, but his final budget proposal envisions federal deficits of more than $400 billion a year for the next two years. As big as those numbers are, experts think that the administration is lowballing the deficits, and they put little stock in Bush’s vow to balance the budget by 2012.

“I think the promise that it will be balanced by 2012 is ridiculous,” said Chris Edwards, director of tax policy for the Cato Institute, a libertarian policy research group.

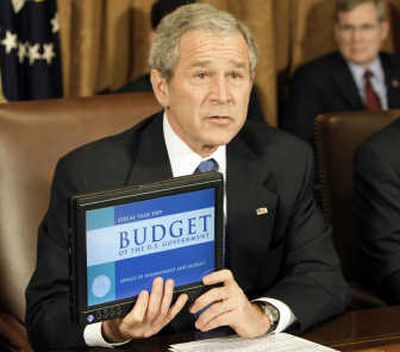

The Bush administration submitted its $3.1 trillion budget for the next fiscal year on Monday.

The proposal set the stage for a long election-year struggle, drawing sharp criticism from the Democratic majority in Congress as well as a smattering of Republicans concerned about the president’s habit of leaving large chunks of the spending out of his annual budget blueprint.

White House aides acknowledged that the new numbers didn’t reflect the full amount that would be needed to prosecute the wars in Iraq and Afghanistan over the next year. The president regularly has handled the two conflicts as emergency spending and therefore outside normal budget channels.

The proposed budget would freeze most domestic spending and limit payments to hospitals and other providers as part of an effort to slow the growth of Medicare. It calls for making permanent Bush’s 2001 and 2003 tax cuts, which have been criticized as skewed to the rich.

Bush’s estimates of a $410 billion deficit this fiscal year and $407 billion for fiscal 2009, budget experts said, rely on very low assumptions of war costs, unrealistic estimates on tax collection and spending cuts that won’t sell politically, regardless of which party is in charge of Congress.

“No sensible analyst takes this (budget) estimate seriously,” said Robert Greenstein, executive director of the liberal Center on Budget and Policy Priorities.

Edwards pointed to $70 billion in emergency Iraq and Afghanistan war costs budgeted for the fiscal year beginning Oct. 1, a figure he called “totally phony” because it could easily end up closer to $200 billion, as it has in recent years.

Although Bush offers a one-year patch to keep the creeping alternative minimum tax from ensnaring millions of taxpayers, his budget would allow the tax to hit 38 million Americans by 2012. That would be tantamount to a huge tax increase.

Late last year, Congress approved a one-year patch for the AMT, a tax that must be calculated in parallel to standard income taxes. This patch wasn’t paid for, however, and so it added to the federal deficit, which will grow by roughly $150 billion once Congress passes an economic stimulus later this month.

To balance the budget later, Bush envisions sharp spending cuts in popular programs for the elderly and a spending freeze on everything the government isn’t required to pay for.

Few expect Congress to make deep cuts in such programs as energy assistance to the poor, disease control and space exploration. And experts don’t see Congress agreeing to Bush’s suggestion to trim Medicare spending by $556 billion over the next decade – just as baby boomers begin retiring after 2010.

Once war costs and revenue lost to AMT patches are factored in, annual federal deficits are likely to exceed $500 billion, forcing the U.S. government to issue more debt.

Gross federal debt accumulated through all U.S. history totaled $8.9 trillion at the end of fiscal 2007 last Sept. 30. That was up sharply from $5.6 trillion at the end of fiscal 2000 and is still projected to rise to more than $12.2 trillion by 2013.