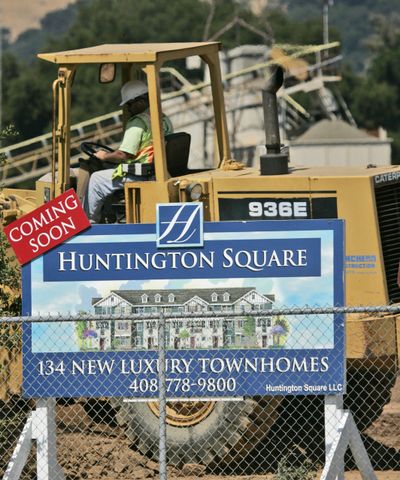

Signs hint at stability

Housing starts see rebound; inflation remains in check

WASHINGTON – Fresh signs that the economy is stabilizing – though at very low levels – emerged Tuesday in reports that home construction rose more than expected last month and wholesale prices remain in check.

The building of new homes and apartments jumped 17.2 percent to a seasonally adjusted annual rate of 532,000 units from April’s record low of 454,000 units, the Commerce Department said. Building permits, an indicator of future activity, rose 4 percent to an annual rate of 518,000 units, also better than expected.

But the gains in construction were driven by a surge in the highly volatile category of multifamily buildings, which soared 61.7 percent in May after plunging 49.4 percent in April. Single-family home construction rose at a much lower rate, 7.5 percent.

Meanwhile, the Producer Price Index, which measures wholesale prices, rose by a seasonally adjusted 0.2 percent from April, the Labor Department said. That was below analysts’ expectations of a 0.6 percent rise.

Despite the increase, wholesale prices fell 5 percent over the past 12 months. That was the largest annual drop in nearly 60 years. Excluding volatile food and energy prices, the core PPI dropped 0.1 percent in May, also below analysts’ forecasts of a 0.1 percent rise.

Falling prices can raise fears about deflation, a destabilizing period of extended declines. But most analysts say efforts by the Federal Reserve to stimulate the economy will prevent deflation.

The latest governments reports, including a seventh straight drop in industrial production, follow a dip in homebuilder confidence reported Monday. Taken together, along with a recent rise in mortgage rates, they depict an economy recovering very slowly from the depths of the longest recession since the Great Depression.

“The bottom line is that housing activity appears to have found a floor, albeit at a low level,” Paul Dales, U.S. economist at Capital Economics in Toronto, wrote in a research note.

Joshua Shapiro, chief U.S. Economist at MFR Inc., said overall median home prices will keep falling, but the bottom end of the housing market “will probably continue to show signs of life as long as first-time buyers can get the financing they need.”

Still, any sustained rebound in home construction isn’t expected until next spring. That’s partly because of the glut of unsold homes and a record wave of mortgage foreclosures dumping more properties on the market.

For April, the number of unsold existing homes on the market rose almost 9 percent to nearly 4 million. And the supply of unsold new homes dipped to 297,000. That amounts to a 10-month supply of new and existing unsold homes at the April sales pace, according to data from the government and the National Association of Realtors, roughly double the amount seen in a healthy housing market.

Separately, the International Monetary Fund boosted its short-term outlook for the U.S. economy. The 185-member IMF expects the nation’s gross domestic product will increase 0.75 percent in 2010, up from an estimate of no growth two months ago.

The fund also projects the U.S. economy will decline 2.5 percent this year, an improvement from its earlier projection of a 2.8 percent drop. The report credited an “increasingly strong and comprehensive policy response” in the form of the Obama administration’s stimulus package and the Fed’s interest rate cuts for the improvement.