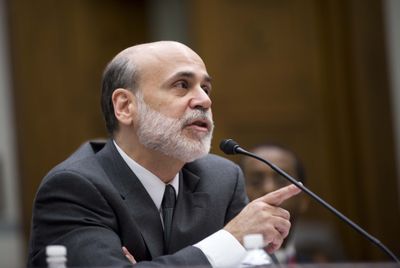

Fed chief denies threat

Bernanke testifies about BofA-Merrill Lynch deal

WASHINGTON – In a mix of gripping political theater and a financial whodunnit, Federal Reserve Chairman Ben Bernanke strenuously denied Thursday that he strong-armed Bank of America into absorbing troubled investment bank Merrill Lynch against its will.

Lawmakers were unmoved, promising to expand their widening probe.

Summoned before the House Committee on Oversight and Government Reform, Bernanke denied that he threatened Bank of America Chief Executive Ken Lewis with removal if Lewis backed out of the government-brokered merger.

“I never made this threat,” Bernanke said in response to questioning by Rep. Darrell Issa, R-Calif.

A day earlier, Issa had issued a news release accusing the Fed and Bernanke of a cover-up – words that he seemed to back away from during a nonetheless aggressive hearing that lasted three hours and 15 minutes.

Asked about the treatment of Bernanke, White House Press Secretary Robert Gibbs said that President Barack Obama retains confidence in the Fed chief, whose four-year term expires in February.

Bank of America’s $50 billion acquisition of Merrill Lynch came amid the global financial panic last fall, when the Fed and the Treasury Department aggressively brokered the sale of Wachovia and Merrill Lynch, and the Federal Deposit Insurance Corp. seized and sold the nation’s largest thrift, Washington Mutual.

Lawmakers are probing the Merrill acquisition because the deal almost fell apart in mid-December after Merrill warned of worse-than-expected fourth-quarter losses. Then the nation’s largest commercial bank, Bank of America, considered citing “material adverse changes” to back out of the deal. Taxpayers eventually stepped in to provide $20 billion in emergency lending to those two banks as a consequence.

Bank of America’s share prices plunged amid the confusion and haven’t recovered.

Shareholders have sued Lewis for failing to inform them of material changes in the company’s health as a result of the Merrill losses that Bank of America absorbed.

Lewis brought more attention to this dispute by suggesting that he’d been strong-armed into the acquisition.

Following Thursday’s hearing, the panel’s chairman, Rep. Edolphus Towns, D-N.Y., suggested that Bernanke’s testimony only raised the need to probe further.

He promised to haul former Treasury Secretary Henry Paulson before the committee in July and said he now wants to talk also with officials from the Securities and Exchange Commission and the FDIC.

“There are significant inconsistencies between what we have been told today and what we were told two weeks ago by Ken Lewis and what Fed internal e-mails seem to say,” Towns said.

Paulson has testified to New York Attorney General Andrew Cuomo that he threatened Lewis with removal on behalf of the Fed chairman.

Paulson later amended that to say the threat was his, but was consistent with the Fed’s strong concern about Bank of America backing out of the deal.

Bernanke’s statement is squarely in conflict with what Lewis testified under oath.

He told the same panel on June 11 that he’d been threatened with removal if he tried to back out of the deal to absorb Merrill.