Briefcase

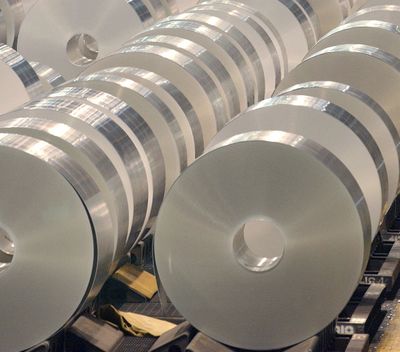

Alcoa Inc. reports jump in Q4 earnings

DENVER – Alcoa Inc. said Monday its fourth-quarter earnings jumped on higher sales to a range of businesses, from aerospace to commercial construction.

It marked the third consecutive quarterly profit for the aluminum manufacturing giant, which appears to have turned the corner after recording losses in 2008 and 2009 because of the recession. The company also expects business to continue to improve.

Alcoa said sales improved in key markets; including aerospace, commercial construction, industrial gas turbines and distribution.

Associated Press

Fed paying U.S. billions in earnings

WASHINGTON – The Federal Reserve is paying a record $78.4 billion in earnings to the U.S. government, reflecting gains from the central bank’s unconventional efforts to lift the economy.

The payment to the Treasury Department for 2010 is the largest since the Fed began operating in 1914. It surpasses the previous record $47.4 billion paid in 2009, the Fed said Monday.

The bigger payment mostly came from more income generated by the Fed’s massive portfolio of securities, which includes Treasury debt and mortgage securities.

Associated Press

Duke Energy buying Progress Energy

NEW YORK – Duke Energy Corp. is buying Progress Energy Inc. for more than $13 billion in stock in a deal that would create the utility with the most customers in the U.S.

The new company’s size will allow it to better afford replacing aging transmission infrastructure and old power plants that are struggling to keep up with tightening environmental regulations.

The transaction announced Monday by the two North Carolina companies would create a business with about 7.1 million electric customers in North Carolina, South Carolina, Florida, Indiana, Kentucky and Ohio.

Associated Press

More charges in insider trading case

WASHINGTON – Federal regulators on Monday charged the co-founder of a New York hedge fund and three other individuals with insider trading, the latest action in what the government has called the biggest insider trading case in U.S. history.

The Securities and Exchange Commission announced it filed a civil lawsuit against hedge fund Trivium Capital Management, its co-founder Robert Feinblatt and analyst Jeffrey Yokuty. The SEC also filed charges against Sunil Bhalla, a former executive of tech company Polycom, and Shammara Hussain, a former employee at a consulting firm that did work for Google.

So far the SEC has filed civil charges against 27 people and hedge funds in a wide-ranging probe of the Galleon group of hedge funds and its founder.