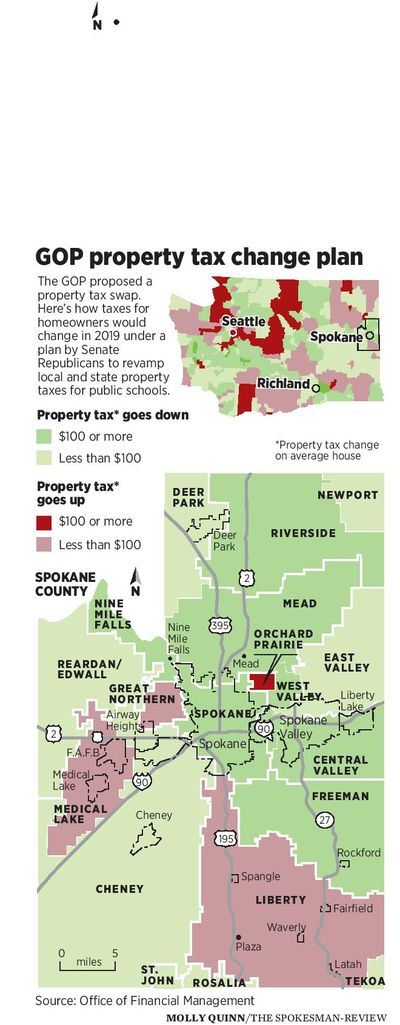

New analysis shows GOP school-funding plan would lower taxes in Spokane, raise them in Seattle

OLYMPIA – Average homeowners in the Spokane Public School district would see their property taxes drop $152 in 2019 if Senate Republicans are successful in reforming the way Washington pays for public schools.

Average homeowners in the Seattle School District would see their property taxes go up by about $1,300 that year.

After that, who knows?

Property owners throughout the state’s 295 school districts would see a shift in their taxes in 2019 – some small, some large – if the GOP proposal for a major overhaul of the way the state collects and spends money for public schools becomes law. Republicans pushed it through the Senate a week ago over Democrats’ objections, amid charges and counter-charges of who would pay more taxes and whether some school children would be short-changed.

There’s a long way to go, and House Democrats have a significantly different proposal with no tax plan attached, so it’s impossible right now to make direct comparisons.

But late this week the Office of Financial Management, which analyzes state budgets, did the most complete analysis yet of the GOP proposal, projecting the likely impacts on taxpayers and school districts in 2019, the first full year of the plan.

This “levy swap” would raise about $513 million, or about $110 million more than the total collected last year by the districts through their local levies. The state would send that money back to the districts based on a new formula.

David Schumacher, the state budget director, said there would be clear winners and losers among taxpayers across the state. Schumacher and his budget analysts believe there won’t be any school district that would get less money than this year under the proposed changes in spending, a statement that set off a small firestorm among Democrats.

Schumacher is sticking by that assessment, with an important qualifier: The levy swap only raises about $110 million of the $1.7 billion that the plan would spend. Republicans would have to come up with the rest of that money another way.

Gov. Jay Inslee said Republicans have about 95 percent of their work left to show how they’ll pay for their plan. On the other hand, he said, House Democrats have proposed some good changes in education policies but have yet to offer a plan to pay for them.

Inslee’s proposed budget would spend about $2.4 billion, but relies on new taxes on carbon emissions and capital gains, not a major change in property tax laws. He argues those are fairer ways to spread the burden of raising more money for schools, but said at least Republicans were acknowledging that some type of tax increase was necessary.

“It’s a good starting point,” Inslee said Thursday. “I’m going to be encouraging people to be open to other people’s ideas.”

By getting rid of all local school levies across the state, and replacing them with a statewide levy of $1.80 for every $1,000 of assessed value, property owners in roughly two-thirds of the school districts would get a tax break, because their current local levy is higher. About a third would pay more, because their local levy is lower.

Many of the areas with the highest local school levies are in districts where property values are relatively low. Most of those with the lowest levies are in the metropolitan Puget Sound area, where smaller levies collected on higher property values generate more money.

For its analysis, the Office of Financial Management calculated the average taxable value for a single value home in all 295 school districts for 2016. In Spokane, that’s about $142,000; in Seattle, nearly $409,000.

Homeowners in the Seattle School District, who have some of the highest property values around the state, would have the biggest increase. The nearby suburban districts also would see big increases in property tax bills.

In defending the plan’s shift of tax burden, Republicans argued that Seattle is home to many liberals who regularly call for making the state’s tax system more progressive. Increasing property tax collections from the state’s wealthiest areas is more progressive, they argued.

But not all Seattle-area homeowners are wealthy, and they already pay some of the highest property taxes, Democrats countered.

It wasn’t lost on either side that many of the areas where homeowners would see the biggest property tax jumps have sent Democrats to Olympia, while many of the areas that face the biggest drops have Republican legislators.

Homeowners in Spokane-area school districts would generally see lower property taxes in 2019 under the GOP plan. The property tax on the average home would decrease by $97 in the East Valley School District; by $164 in Central Valley; by $193 in Mead; and by $243 in West Valley, based on the OFM analysis, which projects the new levy rate over each district’s average home value. The average homeowner in the Liberty School District would se an $8 increase, and Oakesdale School District, a $6 bump.

Those tax savings could disappear the next year, Democrats note. The Senate GOP plan removes all local school district levies in 2019, but it allows the schools to ask voters for new smaller levies starting in 2020. The levies couldn’t be used for basic education, such as salaries, transportation or supplies; they’d be limited to extra programs or services the state doesn’t cover.

Republicans contend the state’s property tax levy could also be reduced by future Legislatures, another variable that makes mapping the long-term impact of their proposal more difficult with each passing year.