Higher sales tax on ballot

Spokane County commissioners voted Tuesday to put a sales tax increase for criminal justice and public safety to a countywide vote.

The .1 percent sales tax proposition will be on the September primary ballot. It would cost Spokane County shoppers an additional 10 cents on a $100 purchase and would end in five years unless voters reapproved it.

“I’m merely voting to put it on the ballot for the citizens to choose,” said Commissioner Phil Harris.

Both Harris and Commissioner Kate McCaslin said that the rising costs of public safety, courts and incarceration are draining the county’s budget reserve.

But Commissioner John Roskelley voted against putting the tax on the September ballot.

“There’s no accountability to the taxpayer for the tax collected. It’s the equivalent of a blank check,” said Roskelley, who argued that the parameters of criminal justice and public safety are too broad, and that there isn’t enough time before the primary election to educate voters.

But McCaslin chastised Roskelley for now wanting to leave the county’s funding issues to future commissioners, even though he’s advocated in the past for property tax increases, which can be used for any general fund purpose.

“I think it’s a very narrow ballot title, and the voters can have a high level of confidence that it will go to improving safety in our community,” she said.

Some said Tuesday that the proposition may have a difficult time passing.

“I would be very surprised if it passes. People out here are not interested in an increase in sales tax,” said Deer Park Mayor Michael Wolfe.

One potential hurdle for the sales tax is that the Spokane Valley City Council voted last week to place a property tax issue on the same September ballot.

There’s a real possibility that voters in Spokane Valley will be turned off by seeing two tax propositions at the same time, said Spokane Valley Mayor Mike DeVleming, who added that he’s concerned the commissioners didn’t consult more with Spokane Valley leaders.

And this is the second time this year that local government has asked the public for a sales tax increase.

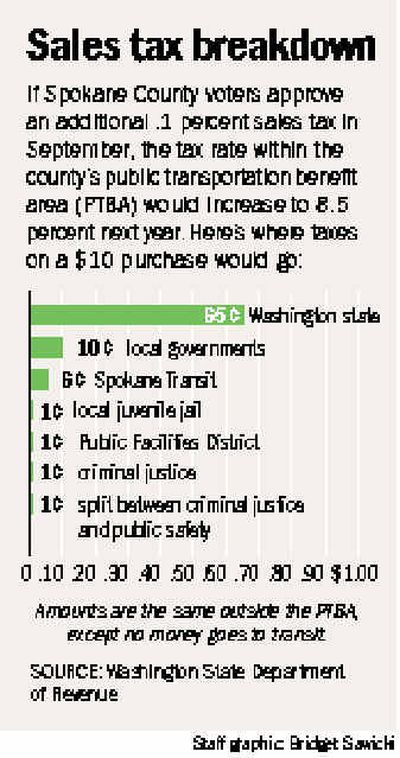

In May a .3 percent sales tax increase (30 cents on a $100 purchase) for Spokane Transit Authority overwhelmingly passed. On Oct. 1, that increase will bring sales tax in most of Spokane County up to 8.4 percent – $8.40 on a $100 purchase.

The commissioners’ proposal would increase the sales tax starting in 2005 to 8.5 percent – one of the highest in Washington.

Only the highly populated Puget Sound counties of King, Kitsap, Snohomish and Pierce currently have 8.5 percent sales tax or higher, according to the Washington State Department of Revenue. Currently, the highest sales tax in the state is 8.9 percent, collected in parts of Snohomish County.

The sales tax is one of the few remaining ways for local governments to raise revenues, and they’re using it, said Mike Gowrylow, a spokesman for the Washington State Department of Revenue.

“It’s been a trend lately across the state,” Gowrylow said, adding that Walla Walla County has already taken advantage of a 2003 state law allowing up to a .3 percent sales tax increase for criminal justice and other uses.

In addition to Spokane County, Yakima and Kitsap counties will also try to use the law to increase revenues.

According to the law, at least one-third of proceeds from the new tax must be used for criminal justice, with the remainder to be used for any purpose approved by the voters – in Spokane County’s case, public safety.

Spokane County estimates the tax would raise $6 million per year.

Of that, 60 percent would go to the county, and the rest would be split among local towns and cities based on population.

That means Spokane would get about $1.5 million while a small town such as Fairfield would get $4,500 per year.

“This is a lot of money to towns like Fairfield and Waverly,” McCaslin said. “They’re desperately scratching for every dollar.”

But while their cities stand to benefit, local leaders so far haven’t publicly come out in favor of the tax.

In an e-mail to the commissioners, Spokane Mayor Jim West wrote that his top priority is a street bond issue next year, and the best he could do is remain neutral on the sales tax issue.

“I’ll support your decision and will not second-guess the county’s position on this. I will not take a negative position at any time during the campaign,” West wrote. “I won’t however be a public spokesperson for this at this time.”

The lack of support or condemnation from local leaders doesn’t sit well with Harris.

“I have a hell of a lot of heartburn that the mayors of this county didn’t jump up to say put this or don’t put this on the ballot,” he said. “Having said that, I’m willing to take the heat.”