Leading indicators off again

NEW YORK — A widely watched barometer of future economic activity edged lower in September for the fourth month in a row, suggesting a slowing in economic growth, a private research group reported Thursday.

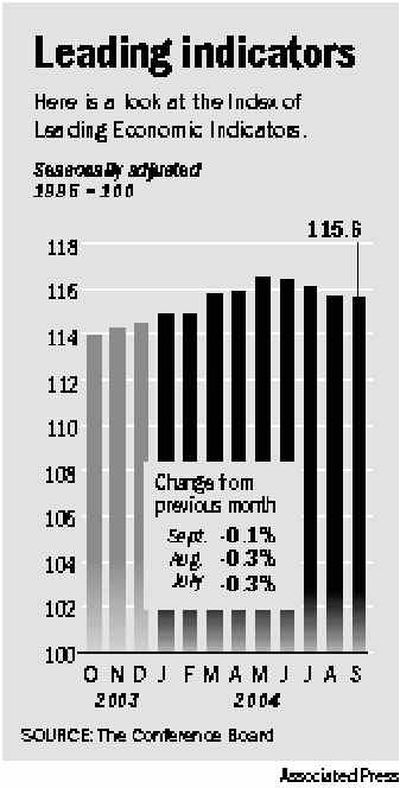

The Conference Board said that its Index of Leading Economic Indicators fell 0.1 percent last month, following declines of 0.3 percent in August and 0.3 percent in July.

The group said that while the weakness over the last several months in the economy has become more widespread, the declines in the leading indicator index are not yet large enough nor have they lasted long enough to suggest that the current economic expansion is ending.

The index is closely followed because it is designed to forecast the economy’s health over the coming three to six months.

The decline in the index was slightly less than the decline of 0.2 percent that some analysts were expecting. The 10-year Treasury bond, which tends to rise on indications that the economy is cooling, edged up 1/16 point to yield 3.98 percent, down from 3.99 percent late Wednesday. Stock market indicators were mixed.

Josh Feinman, chief economist at Deutsche Asset Management, called the decline in the leading indicators index consistent with other recent signs of slight deceleration on the economy, but he cautioned that signals remained mixed, making predictions difficult.

However, he noted a separate report from the Labor Department on Thursday showed a slight decline in the total number of people receiving unemployment benefits, which he called an indication that the labor market has been “plodding toward improvement.”

The Labor Department also reported that the number of new people signing up for jobless benefits fell sharply last week, by a seasonally adjusted 25,000 to 329,000, marking the lowest level since early September and coming in slightly ahead of economists’ expectations. Claims had risen by 16,000 in the previous week.