Oil prices rise to record highs

NEW YORK — Oil prices marched to new heights, hitting a new intraday high near $60 a barrel even as the president of OPEC said Monday the group will consider raising its output ceiling by half a million barrels as early as this week.

The Organization of Petroleum Exporting Countries raised its output target by that amount just last week. The move appeared to have little impact on prices, which have risen by almost $12 a barrel in the past month because of concerns about limited refining capacity and rising demand for gasoline and diesel.

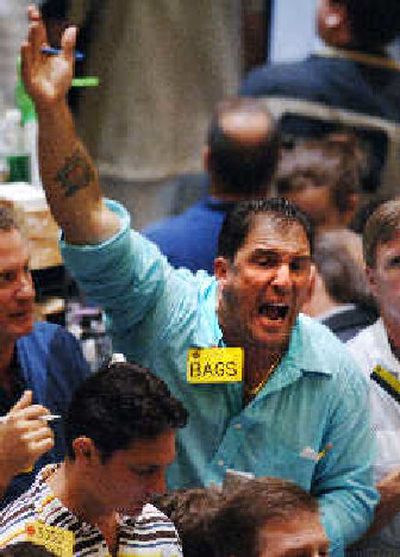

Light sweet crude for July delivery climbed 90 cents to settle at $59.37 a barrel, a record close on the New York Mercantile Exchange, where oil futures have been traded since 1983.

Gasoline prices in the U.S. average about $2.13 a gallon, an increase of more than 40 percent over the past two years, but government data released last week showed that demand is up almost 3 percent from a year ago over the past four weeks at nearly 9.5 million barrels a day — a growth rate that surprised many analysts.

“The economy has accepted $50 oil. We accepted $2 gasoline too,” said oil tycoon Boone Pickens, who runs a billion-dollar hedge fund that invests in energy commodities and equities.

While soaring jet fuel costs have been a major problem for the airline industry, higher energy prices have not taken as much of a toll on the broader economy as many analysts had previously feared. In the first three months of the year, the U.S. economy grew at a 3.5 percent annual rate, according to the Commerce Department, slightly slower than the 4.5 percent pace a year earlier.

The prospect of another attempt by OPEC to cool prices did not impress brokers, who said the effort could actually backfire by highlighting the group’s dwindling excess production capacity.

Still, “it looks like we might have difficulty holding these levels,” said Mike Fitzpatrick, an oil broker at Fimat USA in New York. “You’re seeing a great deal of reluctance among buyers to pay these higher prices.”

Oil analyst Andrew Lebow at Man Financial in New York said “once we’re in this $55-$60 area, it’s been kind of hard to justify. But it is what it is. It seems like we’ll hit $60 at this point.”