Teamwork for fun and profit

Many investors aren’t boasting about their investment returns last year.

Among the major stock market barometers, Standard & Poor’s 500 index was up about 4 percent in 2005, while the Dow Jones industrial average was flat as a tabletop.

Not everyone, though, had such ho-hum returns.

Some of the best investment clubs — groups of average investors who pool their money and know-how to buy stocks — regularly outperformed the market. The principles that guide them are basic strategies that have been around for decades because they tend to work.

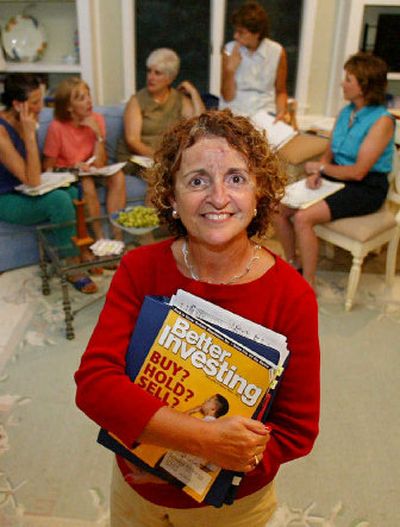

“We buy and hold. We don’t sell too much. We take a long time to make a decision to buy something,” said Carol Gordon, president of the Women Investing in Security & Education in Oak Park, Ill. The 10-year-old WISE was named the No. 1 club in the country this year by Value Line, a publisher of stock information.

Judges based their decision on clubs’ long-time performance, portfolio diversification and other factors. Gordon said WISE has an average annual return of 14 percent, which includes dividends and stock price appreciation. Last year, the club’s portfolio was up 11.5 percent, she said.

So, if you’re prepared to stop trying to find the next Google and want to learn some basic techniques, here’s advice from some of the top clubs:

It’s not how much you invest. You don’t need a lot of money to succeed. Small sums can build into a significant portfolio over time.

The Holden Investment Club in Massachusetts was launched 50 years ago. Initially, each of the 10 members contributed $10 a month, and later raised it to $20, said founder Charles Keith, 78, a former milkman and postman.

All but one member stopped making contributions a decade or so ago. Over the years, contributions totaled $79,000, and $200,000 has been withdrawn, Keith said. Even so, the portfolio is worth more than $1 million, he said.

Do your homework. Often each club member investigates a stock and makes a recommendation to the club. WISE starts by identifying an industry it wants to add to the portfolio, and then a member scouts out the best company in that group, Gordon said. Members will read Value Line’s research reports, newspaper articles and annual reports for information on a company.

Research can be fun. Members of Women of Wealth in Memphis, Tenn., liked Chico’s clothing, so the club contacted the retailer to request information before investing.

“They had us over to one of the stores, gave us drinks and a discount on clothes,” said Lelaine Cleaves, club president. That sold Women of Wealth on the stock, which has since become one of the club’s top performers.

Before investing, contact a company’s investor relations department, which has loads of useful information and might even make upper management available to answer your questions, Cleaves said.

Earnings count. Back in the Internet boom of the 1990s, upstarts didn’t even have to earn a dime to attract millions of dollars from eager investors.

Gordon’s club won’t invest in a company that doesn’t have a five-year track record of earnings. Clubs typically look for companies whose earnings are growing 15 percent or more a year. That tends to lead them to invest in small- or medium-sized companies, members said.

Tips are for restaurants. “Don’t buy stocks based on tips,” said Martin Bates, treasurer of the Central Oklahoma Investment Club of Chickasha. “If the stock is going up and everyone is buying it, it’s a good chance you are too late.”

Don’t fall in love. Clubs generally assign a stock for each member to keep tabs on.

“The biggest problem is falling in love with a stock,” where a member has grown too attached to a stock that she can’t see its faults, said Gordon. WISE members rotate stocks each year to maintain a fresh perspective.

The Chickasha club keeps emotions at bay by establishing a price target at which point the club will buy or sell a stock.

Avoid frequent trading. Studies show that investors who jump in and out of stocks have lower returns because of the commissions they pay. Clubs will sell stocks, but tend not to be heavy traders.

“We’re in it for the long term. We expect to hold a stock at least five or 10 years,” Bates said.

Diversify. Clubs spread their money around, making sure they’re not too heavily weighted in a single stock or industry. WISE’s portfolio includes companies in retail, food wholesales, financial services, pharmaceutical, home building, assisted living, technology, video games and waste management. No single stock can make up more than 15 percent of the portfolio, Gordon said.

Clubs also avoid owning so many stocks that they can’t keep track of them.

Join the club. If you’re uncomfortable investing on your own, consider starting your own club with a group of friends or co-workers. The Chickasha club was established 13 years ago by a group of men between 35 and 45 years old, Bates said. “Although many of us were professional, we just really didn’t know where to begin investing on our own,” he said.

The National Association of Investors Corp. at www.betterinvesting.org offers advice and tools for starting a club.

Cleaves, of Women of Wealth, said members have become more confident about finances, and some no longer have a problem with investment professionals talking over their heads.

“Knowledge is power,” she said.