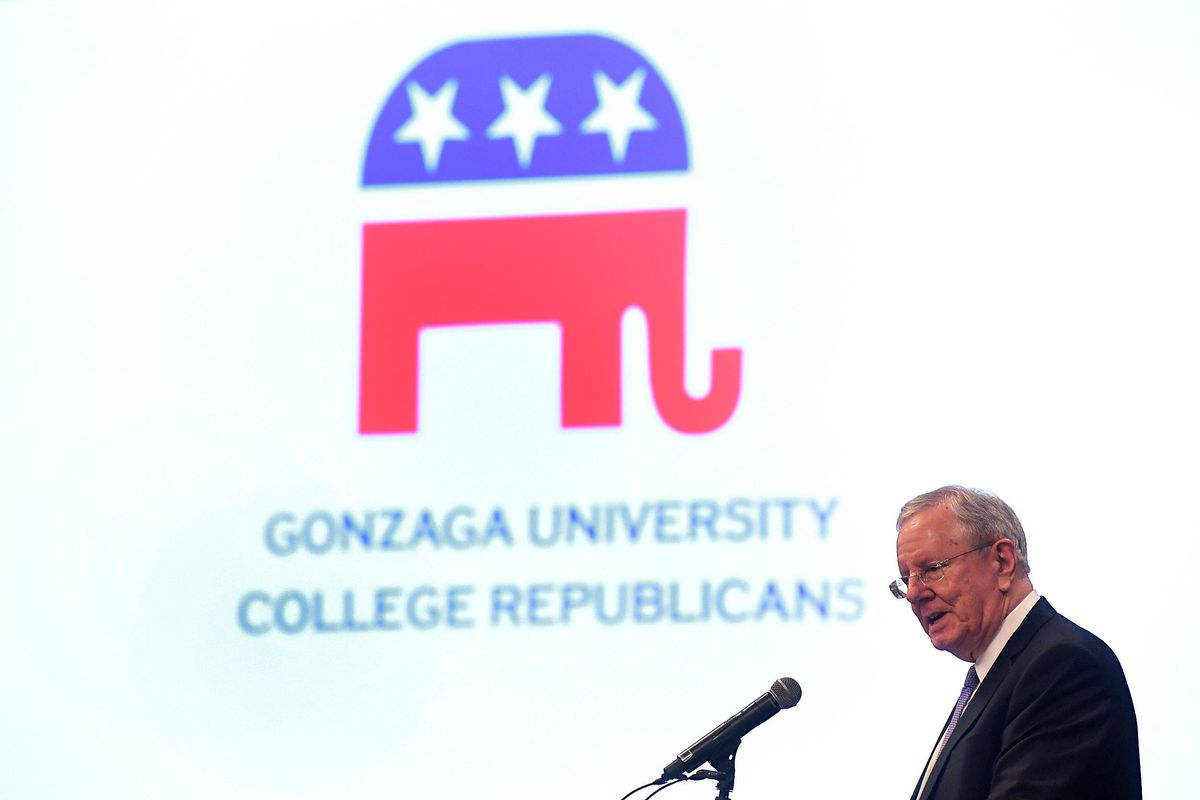

Steve Forbes brings folksy talk on economics to Gonzaga

Publisher Steve Forbes gave a folksy talk on economics at Gonzaga University on Wednesday night, mixing observations about capitalism and free markets with dating and investment advice for millennials.

“If you’re ever on a bad date and want out, bring up monetary policy,” quipped the editor-in-chief of Forbes, the business magazine founded by his grandfather and run for more than 25 years by his father, Malcolm Forbes.

Forbes also told the crowd to stuff their “inner Warren Buffet” when they’re saving for retirement. “Go for index funds with low overhead expenses,” he said. Over time, “you’ll outperform the market.”

His talk on “How Capitalism Will Save Us” drew frequent chuckles from about 800 people in the Hemmingson Center ballroom. Forbes’ appearance was sponsored by GU’s College Republicans club.

Forbes, a two-time presidential candidate, gave a strong defense of capitalism, which he said remains the best economic system for people to improve their lives.

“We’re always told markets are inhumane,” he said. “The rich get richer. Profits before people.”

But, “even if you don’t love your neighbor, you want to sell to your neighbor. It has you reaching out,” he said.

Capitalism also rewards talent like no other system in history, Forbes said, bringing together people of diverse backgrounds. “Commerce breaks those barriers down to do great things.”

And a free market system allows former luxury items to become affordable for the masses, he said. Before Henry Ford, automobiles were “toys for the rich,” Forbes said. More recent innovations have made cellphones and flat-screen TVs household items.

“Free markets always, always if allowed to work will turn scarcity into abundance,” he said.

During his talk, Forbes addressed Monday’s market correction, which he called “why stocks are wobbly right now.”

“The market is not overpriced, but it’s worried,” he said.

The weak U.S. dollar, fears of international trade wars and uncertainty about the Federal Reserve’s action on interest rates are rattling the stock market, he said.

“It’s one thing to update a trade agreement, like NAFTA. It’s quite another to blow the thing up. It’s going to be a disaster,” he said.

He had harsh words for “our friends at the Federal Reserve, who should be sent to North Korea and stay there. … They shouldn’t be jerking up interest rates. Leave it alone.”

Forbes championed a flat-income tax rate during his 1996 and 2000 presidential runs. He’s still a strong advocate, he said Wednesday night. While the tax reform passed by Congress last year helped corporations, it didn’t go far enough to provide relief on personal taxes, Forbes said.

“I hope in a couple of years, they go back and get it right,” he said. “There should be no tax on savings. No death tax. You should be able to leave this world without being molested by the IRS.”

Forbes devoted part of his talk to the state of U.S. health care, which he said would benefit from a free-market approach.

“There is a disconnect between consumers and providers,” Forbes told the crowd.

Consumers should be able to shop for the best deals on health insurance policies, he said. And Forbes thinks hospitals and clinics should post prices online, so customers can compare costs. Greater transparency would help keep costs down and allow consumers to evaluate the effectiveness of care at different facilities, he said.

Dave Saulibio, who watches Forbes on Fox News, said he came to Wednesday’s talk to hear a nationally-known business leader in person. During the question-and-answer period, Saulibio asked if Forbes was worried about the rising national debt.

Forbes defended the recent tax cut. A vibrant, growing economy is “the only way to have a balanced budget,” even if it raises the deficit in the short-term, he said.

Adam Smith, a GU senior studying information systems, asked Forbes for his thoughts on Bitcoins and cyrptocurrency.

Until Bitcoins have a stable value, they’re worthless as currency, Forbes said.

“Don’t have any illusion it’s an investment,” he said of cryptocurrency. Forbes compared investing in Bitcoins to buying lottery tickets and dreaming of quick riches.

“It’s not an investment, but a ticket to entertainment,” he said.