Demand for workers remains strong despite mounting economic gloom

U.S. employers remained eager to hire in May, adding fuel to a red–hot labor market that continues to serve as a bulwark against growing recession fears.

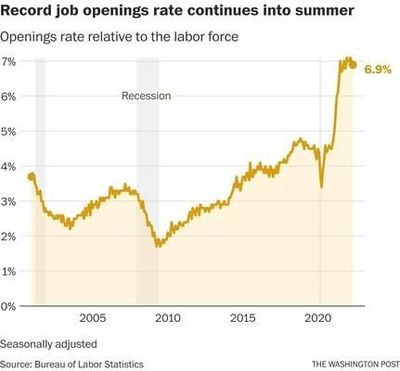

Employers posted 11.3 million job openings in that month, down from a peak of 11.8 million in March and 11.4 million in April but still well above pre–pandemic levels, according to a report released Wednesday by the Bureau of Labor Statistics.

Roughly 4.3 million Americans quit or changed jobs in May, reflecting a job market where workers continue to have the upper hand. Overall hiring, meanwhile, slowed slightly, with businesses adding 6.5 million workers in May, compared with 6.6 million a month earlier.

Layoffs, meanwhile, remained near record lows.

“This is not what a recession looks like,” said Nick Bunker, an economist at the jobs site Indeed. “Demand for workers might be stagnating, but it’s still at very elevated levels. The labor market is not signaling a recession.”

Hiring remains healthy despite mounting signs of economic gloom. Inflation – which has lifted the price of gas, groceries and goods – is near 40–year highs. Consumer sentiment is at an all–time low.

And more economists and forecasters are predicting a recession within the next year.

Those fears have rattled investors and taken a toll on financial markets. Oil prices plunged as much as 10% on Tuesday, with U.S. crude prices falling below $100 per barrel for the first time in May.

The stock market, meanwhile, continued to tumble after closing out its worst first–half of the year since 1970 before the July 4 holiday. Markets dipped lower Wednesday morning after the jobs report, but rebounded later in the day.

The strong labor market and low unemployment rate – at a pandemic low of 3.6% – have remained a source of optimism for economists and policymakers.

Federal Reserve officials have routinely cited tight labor conditions as a key reason they feel comfortable hiking interest rates to cool the economy. The hope is that they can tamp down on inflation without sending unemployment soaring.

Fed officials say they expect the job market to remain strong but worry that risks to the economy are rising, according to details from the central bank’s June meeting that were released Wednesday afternoon.

U.S. employers added a blockbuster 390,000 jobs in May, following nearly one year of at least 400,000 new jobs per month.

The next big test comes Friday morning, when the Labor Department reports June employment figures.

Although labor market growth is widely expected to moderate, a marked decline is unlikely.

“We’re hearing a lot about a looming economic slowdown, but someone forgot to tell the job market,” Bledi Taska, chief economist at Lightcast, a labor market data and analytics firm, said in an email.

“Even if the economy settles from the pandemic shock waves, and slips into a recessionary period, the U.S. will still likely have around 7 million job openings.”

The rapid rebound comes after more than 20 million people lost their jobs in the first months of the pandemic.

Since then, U.S. employers have tried to hire back many of those workers by offering higher wages and more flexible schedules.

Some of the biggest hiring gains in recent months have been in professional and business services; leisure and hospitality; and trade, transportation and utilities.

That trend continued in May, Labor Department data shows, with each of those industries adding at least 1 million new workers.

However, some sectors, such as wholesale trade and the federal government, reported an increase in layoffs.