As GOP rivals collapse, Wall Street warms to second Trump term

Wall Street executives who had pined for a GOP alternative to Donald Trump face a stark dilemma after Tuesday’s New Hampshire primary appeared to affirm that Trump is on his way to becoming his party’s presidential nominee for the third consecutive election.

By the end of Trump’s only term, many of the biggest names in corporate America and high finance were openly criticizing Trump over his denial that he lost the 2020 election and his subsequent role in fueling the Jan. 6, 2021, insurrection at the Capitol. But with Trump likely to face President Biden again this year, some business titans have publicly softened their opposition in recent days, potentially signaling a desire to work with Trump if he lands back in the White House.

Trump advisers have begun reaching out to some of the top donors to Ron DeSantis after the Republican Florida governor suspended his campaign Sunday, according to two people who spoke on the condition of anonymity to reflect private talks. Although former South Carolina governor Nikki Haley has a fundraiser scheduled with top donors in Manhattan for Jan. 30, some Trump advisers are optimistic that some of her wealthiest backers could also be up for grabs after she lost the first two Republican primary contests, the people said.

“You have many Republican donors who thought they’d cut their last check to Trump getting ready to open their wallets again very quickly,” said one GOP strategist, speaking on the condition of anonymity to reflect private deliberations. “There may be stages of grief, but they’ve largely already cycled through them by now, and it’s just a matter of time and scale for how they come in for Trump.”

Anthony Scaramucci, who briefly served as a Trump spokesperson and is now managing partner at SkyBridge Capital, said the recent World Economic Forum conference in Davos, Switzerland, showed that Wall Street is already warming to Trump. Scaramucci is now a Trump critic.

“Based on my observation of the executives at Davos, public interviews and private conversations, my view is that the Wall Street people think Donald Trump is going to win. So the resistance is already softening,” Scaramucci said. People on Wall Street “are preparing for another Trump presidency and some are quietly liking it because they see it as another phase of deregulation and pro-business growth ideas, but you have to be careful what you wish for.”

The choice facing top donors reflects the broader challenge facing corporate America: Executives and wealthy backers alike are torn between what they see as the pro-growth economic policies of Republicans and what they regard as the potential dangers of another Trump term, including massive new immigration restrictions, a global trade war and the destabilization of democratic institutions. The relationship between corporate America and the GOP hit a low point after the Capitol insurrection, and many influential business leaders denounced Trump.

Wall Street leaders, however, appear to be tempering their criticisms now with Trump emerging again as a credible contender for the White House, in what strategists widely interpret as an attempt to smooth over the previous tensions between the business community and the former president. In Davos, JPMorgan Chase chief executive Jamie Dimon criticized “negative talk about MAGA” and said demonizing Trump supporters was a mistake, as he praised aspects of Trump’s first-term record.

“Just take a step back, be honest: He was kind of right about NATO, kind of right about immigration. He grew the economy quite well; tax reform worked. He was right about some of China. I don’t like how he said things about Mexico, I don’t like – but he wasn’t wrong about some of these critical issues,” Dimon said of Trump. Dimon was discussing Trump’s view that NATO member countries besides the United States should pay more as part of the military alliance.

In 2018, during Trump’s first term, Dimon sometimes took a harsher line as he flirted with his own presidential bid.

“I think I could beat Trump … because I’m as tough as he is; I’m smarter than he is,” Dimon said then. “And by the way, this wealthy New Yorker actually earned his money; it wasn’t a gift from Daddy.”

Other business leaders have sounded similar notes.

In 2022, Steve Schwarzman, chief executive of the massive private equity firm Blackstone, said, “It is time for the Republican Party to turn to a new generation of leaders, and I intend to support one of them in the presidential primaries,” according to CNBC.

At Davos this year, however, Schwarzman declined to rule out supporting Trump.

“I think we have to see what happens,” he said.

Executives on Wall Street and elsewhere in corporate America benefited from many aspects of the Trump presidency. The president in 2017 signed legislation that cut the corporate tax rate from 35% to 21% and lowered some individual taxes for the highest earners, and Trump’s administration also advanced a deregulatory agenda that business groups widely lauded.

But those benefits were offset by other policies, including Trump’s expensive tariffs on China – largely maintained by Biden – and a whirlwind global trade policy. Trump is threatening to dramatically expand those disruptive trade policies, discussing putting 10% tariffs on $3 trillion in annual imports. (Most of the costs of such tariffs are typically paid by companies trading with China or by consumers through higher prices, not by the Chinese government or Chinese firms directly.) He is also proposing mass deportations of immigrants if elected, another measure likely to meet strong resistance on Wall Street and in corporate America.

Even so, corporate America might gain more from Trump. He has eyed cutting the corporate tax rate again, and many executives oppose the Biden administration’s efforts to raise the corporate rate to 28% and impose a new wealth tax on billionaires.

“People in business will fall in line with whoever is the next president, and in the case of Trump, you saw that with Jamie Dimon’s views,” said Komal Sri-Kumar, president of Sri-Kumar Global Strategies, an economic consulting firm.

Sri-Kumar cited the tough stances taken by the regulators appointed by Biden to lead the Federal Trade Commission and Securities and Exchange Commission: “There has been a lot of regulation from the FTC and SEC over the last four years, and those are more of a concern for businesses than immigration, which is more of a long-term issue.”

On questions of upholding democracy, Kumar added: “If you’re responsible to your shareholders and your shareholders judge you on your profitability, that can come from a more or less democratic administration.”

Some analysts argue that Trump is good for investors, even if a renewed trade war could drag on growth.

“Investors know President Trump was good for markets last time and is quite likely to be good for markets next time,” said Stephen Miran, who served as a senior adviser for economic policy in the Treasury Department during Trump’s administration. “As long as you create an overall economic policy mix that will boost the economy and compensate for any drags in one part of the policy agenda, overall the economy could do quite well.”

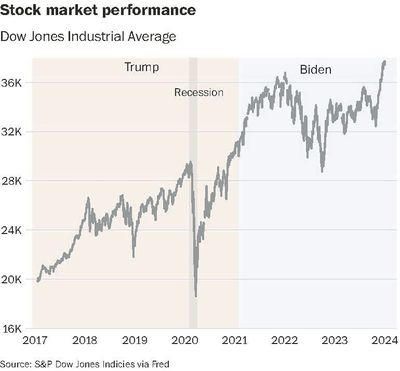

Stocks performed well under Trump, but they have also soared under the Biden presidency, with the S&P 500 closing at a record high earlier this month amid strong signs of economic growth for this year.

For now, it remains unclear precisely how many of the big donors to DeSantis or Haley will migrate to the former president. Hedge fund manager Paul Tudor Jones, a top donor to DeSantis and former New Jersey governor Chris Christie – who also suspended his presidential bid as Trump surged – declined to comment on whether he would donate to Trump, as did hotel magnate Robert Bigelow, who donated $20 million to a DeSantis super PAC and has publicly suggested he could flip to Trump.

“Some business leaders will say, ‘Isn’t it bad to have a wildly unstable society, and bad for profits if we pull out of NATO and embolden Russia’s ambitions in Ukraine?’ ” said Michael Strain, an economist at the American Enterprise Institute, a center-right think tank. “But I think Wall Street is overall going to be very reluctant to speak out against Trump. There’s going to be some whiplash.”