House Rev & Tax passes new tax cut bill, sends straight to full House

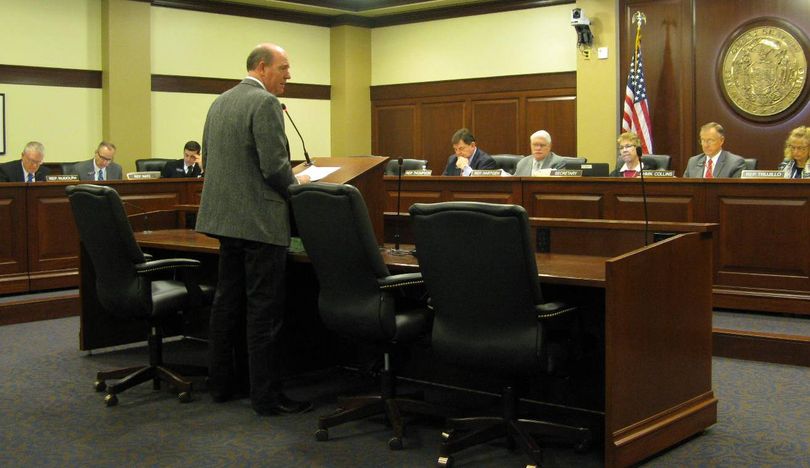

The new tax-cut bill, which incorporates both cuts to state income tax rates and a redefinition of “nexus” for sales tax purposes to require more large retailers to collect and remit sales taxes on Idahoans’ online purchases, was introduced in the House Revenue & Taxation Committee this morning and immediately sent to the full House, on a 12-3 vote.

House Majority Leader Mike Moyle, R-Star, told the committee the bill “deals with subjects you’ve already seen this year … parts of ‘em anyway.” The bill incorporates the tax-cut portions of HB 380, Moyle’s tax-cut bill that died in a Senate committee last week; and the online sales tax portions of Rep. Lance Clow’s HB 581, which cleared the committee earlier and went to the House’s amending order, then was pulled back to the committee.

The new bill would lower the tax rate on all Idaho income tax brackets by one-tenth of a percent, rather than just the top two brackets like HB 380 did. It removes HB 380’s provision to raise the grocery tax credit. Overall, the estimated fiscal impact to the state general fund is that the income tax cuts would reduce revenues by $27.4 million a year, while the “nexus” changes would result in $11 million a year more in state sales tax collections. That results in a net reduction to the general fund of $16.4 million.

“That’s a tax that is already due,” Moyle told the committee, as Idahoans who make online purchases are required to report and pay the equivalent of the state’s 6 percent sales tax on their state income tax returns each year, though many don’t. “That tax is due and it’s not being collected,” Moyle said. “This is a way to hopefully make it easier for our citizens to obey the law, pay that tax, and take the burden off them so they don’t have to put it in the use-tax section on their income tax” return.

Rep. Ron Nate, R-Rexburg, asked, “Are we going to have a full hearing on this bill?” Rep. Gary Collins, the committee chairman, said, “I would guess so, yes.” Rep. Jeff Thompson, R-Idaho Falls, then moved to both introduce the bill and send it to the 2nd Reading Calendar of the full House. Collins said, “So much for what I just said.”

Rep. Heather Scott, R-Blanchard, asked Clow, “For the little guy, the taxpayer, how are they going to know which businesses are collecting the tax and which ones they are going to have to pay use tax for on their own?” Clow responded, “I don’t buy a lot on the internet, but every time I do, it always itemizes whether I owe tax or not,” and whether that tax is being collected as part of the purchase. Clow added that the existing definition of a retailer requires more than two retail sales in the state.

Clow’s proposal amends the definition of which businesses have a legal “nexus” with the state of Idaho that requires them to collect and remit sales taxes on their sales in the state. Currently, that nexus, under a 1992 court decision known as the Quill decision, requires a brick-and-mortar presence in the state. This bill expands the definition to also include businesses that have distribution facilities, marketing, advertising, fulfillment and other operations in the state. Clow said 31 states have or are considering similar legislation. It wouldn’t require all online sellers to collect and remit Idaho sales taxes, but it would expand the list of those who do to include major businesses with substantial sales operations in the state.

Rep. Mark Nye, D-Pocatello, questioned the wisdom of tax cuts, saying Idaho’s overall tax burden is among the lowest of all states and the state needs to fund education. Moyle responded that he believes Idahoans’ tax burden is low simply because Idahoans’ incomes are low; he still thinks rates are too high compared to surrounding states. “We do our best to take care of education and always have,” Moyle said. “We will continue … to make those commitments. … But when we get done making those payments to education, and when we get done with the other functions of government … there’s money left over.” Moyle noted that the latest general-fund reports on budgets set by JFAC so far for next year show $50 million projected to be left over at the end of the year. “We can give back $16 million of that $50 million,” he said.

Nate asked numerous questions about how the internet sales tax collection would work, and called it potentially “a boondoggle, a mess.” He said, "It's being anti-competitive," and said, "They already have an extra burden - the shipping cost ... does somewhat level the playing field." Nate said he also viewed the idea as "unconstitutional, unfair, and impossible to conduct." Moyle responded, “I think you’re reading into this some spooks that aren’t there. … The tax is due.”

Scott said, “I really like the tax cut at the end. I’m just wondering: Why wouldn’t you do that as a stand-alone?” Moyle said, “What we’re trying to do is find support. … It was a way to try to find that spot where everybody could agree as to what’s the best tax policy of the state of Idaho. We were trying to find that sweet spot.”

The only "no" votes came from Reps. Nate, Scott, and Nye.