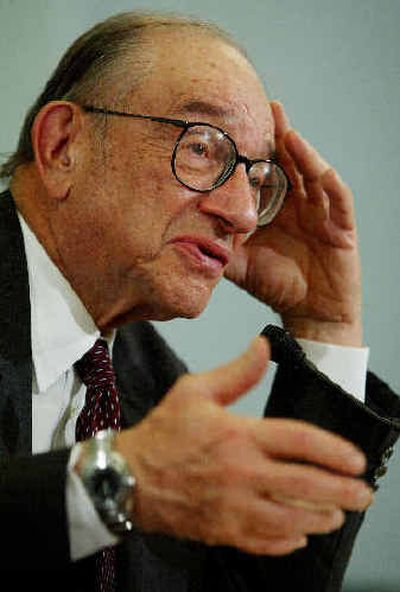

Greenspan: Economy has ‘regained some traction’

WASHINGTON — Federal Reserve Chairman Alan Greenspan said Wednesday the economy has “regained some traction” after a late spring slowdown that was triggered by a sharp spike in oil prices.

Greenspan’s moderately upbeat forecast came as the nation entered the final two months of an election battle in which President Bush and Democratic challenger John Kerry have widely different views on how the economy is performing at present.

Normally, incumbent politicians are unhappy if the Federal Reserve is raising interest rates close to an election.

However, this time around, many private economists believe the Fed is probably helping the Bush campaign by signaling an intention to keep raising interest rates because such a stance supports the administration’s view that the economy has begun to emerge from the recent slowdown.

In his testimony before the House Budget Committee, Greenspan said that two key indicators, consumer spending and housing construction, bounced back in July after a weak performance in June.

“Economic activity hit a soft patch in late spring after having grown briskly in the second half of 2003 and the first part of 2004,” Greenspan told the committee.

“The most recent data suggest that, on the whole, the expansion has regained some traction,” he said.

The Fed has boosted the federal funds rate, the interest that banks charge on overnight loans, from a 46-year low of 1 percent to 1.5 percent in the past two months.

Economists believe the Fed will keep raising rates at a measured pace at coming meetings, including another quarter-point increase on Sept. 21.

Greenspan made no comments in his prepared remarks on the direction of interest rates.

He said that this year’s slowdown “in activity no doubt is related, in large measure, to this year’s steep increase in energy prices.”

The big jump in energy prices acts like a tax on consumers, leaving them less money to spend on other items.

In answer to questions, Greenspan told the panel that if it had not been for the jump in oil prices this year, he believed the country would “still be seeing some very strong growth.”

Greenspan refused, however, to quantify how much the oil price increase had reduced growth, saying it had affected the economy in a number of ways such as depressing consumer confidence.

A big slowdown in consumer spending pushed overall economic activity down from a robust 4.5 percent rate of growth in the first three months of this year to a much slower 2.8 percent growth rate in the second quarter.