Creditors can’t seize IRAs

WASHINGTON — The Supreme Court gave bankrupt Americans another layer of financial protection Monday, ruling that creditors cannot seize their Individual Retirement Accounts.

The unanimous decision shields a nest egg relied upon by millions of people. The justices said IRAs should join pensions, 401(k)s, Social Security and other benefits tied to age, illness or disability that are afforded protection under federal bankruptcy law.

Justice Clarence Thomas, writing for the court, said a bankrupt Arkansas couple was entitled to keep more than $55,000 in retirement savings from creditors. He reasoned that IRAs are benefits tied to a person’s age under the federal statute because a tax penalty is imposed if a person makes withdrawals before age 60.

“That penalty erects a substantial barrier to early withdrawal,” Thomas wrote. “Funds in a typical savings account, by contrast, can be withdrawn without age-based penalty.”

The ruling affects 16 states and the District of Columbia, which do not have their own state laws protecting IRAs. The remaining 34 have separate state laws on bankruptcy protection, with a few of those, including New York, California and Iowa, that have language mirroring the federal bankruptcy statute.

IRAs let most investors contribute up to $4,000 annually to a fund that grows tax-free until withdrawals. It is the retirement plan typically used by workers between jobs, according to AARP, the advocacy group for people over 50.

Unlike many other retirement plans, IRAs permit cash withdrawals for any reason at any time, but holders 59 1/2 and younger must pay a 10 percent penalty for doing so.

Some lower courts had ruled that makes IRAs more like savings accounts, which are unprotected from creditors under bankruptcy law.

In Monday’s opinion, however, Thomas noted that IRA withdrawals by those younger than 60 are few, effectively making the account a benefit based on age. “The deterrent to early withdrawal it creates suggests that Congress designed it to preclude early access to IRAs,” he wrote.

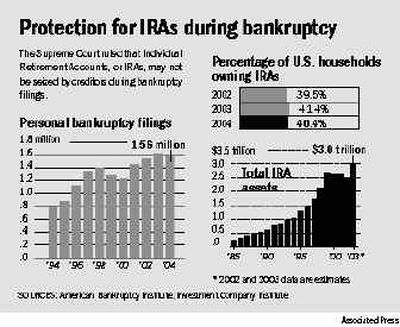

The ruling comes at a time when more people are finding themselves in debt. Last year, about 1.56 million people filed for personal bankruptcy, compared with 875,000 a decade earlier. In 2003, bankruptcy filings peaked at 1.63 million.

“We’re pleased,” said Jean Constantine-Davis, a senior attorney for AARP. “It’s really important to encourage people to contribute savings in their working years and to keep those savings sacrosanct.”

The case involves Richard and Betty Jo Rousey of Berryville, Ark., who accumulated $55,000 in company-sponsored pension and 401(k) plans at Northrop Grumman Corp. before he took early retirement in 1998. When Mrs. Rousey was laid off a month later, they rolled the funds over to IRAs.

The Rouseys have been unable to hold down new jobs, partly due to his chronic back pain, according to their lawyers. Richard, 60, and Betty Jo, 57, now live on $2,000 a month.

Under federal bankruptcy law, their retirement savings won’t be given blanket protection. A separate provision in the law shields the assets only to the extent the money is “reasonably necessary for the support of the debtor and any dependent.”

According to lawyers for AARP, the 16 states principally affected by the ruling are: Alaska, Arkansas, Connecticut, Hawaii, Michigan, Minnesota, New Hampshire, New Jersey, New Mexico, Pennsylvania, Rhode Island, South Dakota, Texas, Vermont, Washington and Wisconsin.

The case is Rousey v. Jacoway, 03-1407.