A year later, China shows no signs of lifting currency

BEIJING — Worried that China’s sizzling economic growth could ignite a financial crisis, the country’s leaders have raised interest rates and imposed regulatory controls. But they have avoided the step that Washington most wants: a sharp rise in the value of China’s currency.

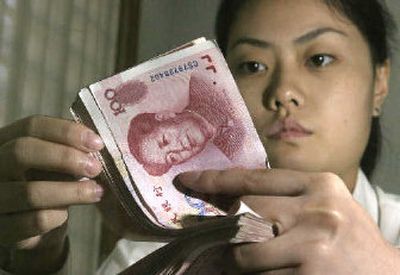

A more expensive yuan would make China’s exports less competitive, shrink its multibillion-dollar annual trade surplus and probably rein in economic growth, now roaring ahead at a 10 percent-plus annual pace.

A year ago this Friday, Beijing revalued the yuan by 2.1 percent and then loosened its decade-long link to the U.S. dollar. Since then, the yuan has been allowed to rise a mere 1.4 percent against the dollar — less than some currencies move in a day.

And China gives no sign it will let the yuan rise significantly any time soon, despite threats of sanctions from U.S. lawmakers and urgings by its own advisers.

“The government is going to use everything but the exchange rate to moderate the imbalances that have shown up in the economy,” said Stephen Green, senior economist for Standard Chartered Bank in Shanghai.

With exports up and inflation down, Chinese officials are reluctant to embrace big changes.

Chinese leaders say they plan eventually to let the yuan trade freely on world markets. But they say doing so too quickly could throw the economy in turmoil and damage the country’s frail banks. They say changes will be dictated not by diplomatic pressure but by China’s own needs.