Fed holds rates steady

WASHINGTON — With inflation moving higher on its worry list, the Federal Reserve held interest rates steady Wednesday, ending nearly a year of cuts to bolster the economy, and hinted that the next direction for rates could be up.

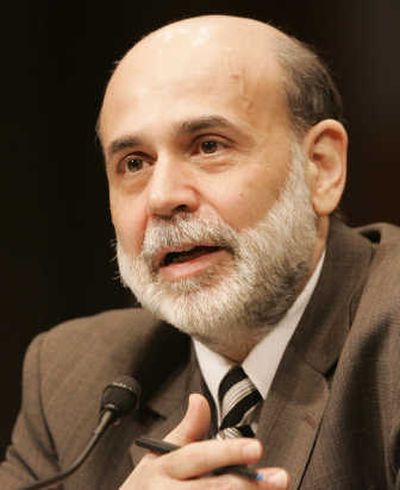

Fed Chairman Ben Bernanke and all but one of his central bank colleagues agreed that the best course was to leave a key rate alone at 2 percent, as the country slogs through the crosscurrents of plodding economic growth and zooming energy and food prices that threaten to spread inflation.

That meant the prime lending rate for millions of consumers and businesses stayed at 5 percent.

The prime rate applies to certain credit cards, home equity lines of credit and other loans.

The decision brought to a close a powerful series of rate reductions that started in September and extended through late April. It was the central bank’s most aggressive intervention in two decades to shore up an economy bruised by the trio of housing, credit and financial crises.

The Fed said it believes its rate cuts will “promote moderate growth over time” as they work their way through the economy. It also said risks that economic growth will falter appear to have “diminished somewhat.”

At the same time, the Fed expressed heightened concern about inflation.

“Upside risks to inflation and inflation expectations have increased,” the Fed said. Inflation eats into paychecks, corporate profits and erodes the value of investments. It is hard to control once it gets out of hand.