Group Health to be acquired by Kaiser Permanente

Seattle’s Group Health Cooperative will be acquired by Kaiser Permanente, the giant California health-insurance and care provider.

Kaiser, which already serves more than 10 million members in eight states and Washington, D.C., will form a new region to absorb the Group Health operations, company executives announced Friday.

The deal marks a significant milestone in the 68-year history of Group Health, formed in Seattle in 1947 with a mission of providing integrated health care and health coverage to Northwest consumers.

“This is an exciting new chapter,” said Dr. Steve Tarnoff, president of Group Health Physicians, who has been with the organization for more than three decades. “This both preserves and promotes our legacy.”

The deal between the two nonprofits joins Group Health’s system with a like-minded, but much larger, partner to position both of them for growth in a changing health-care landscape, said Scott Armstrong, the organization’s president and chief executive.

“This is an opportunity to do more, better,” Armstrong said.

No immediate shifts are planned in coverage and care for current members, officials said.

“Very little will change,” said Kelly Stanford, Group Health’s vice president for clinic operations and market integration in Eastern Washington. “We’ll still be locally operated and locally managed. The services we provide will continue in the same locations.”

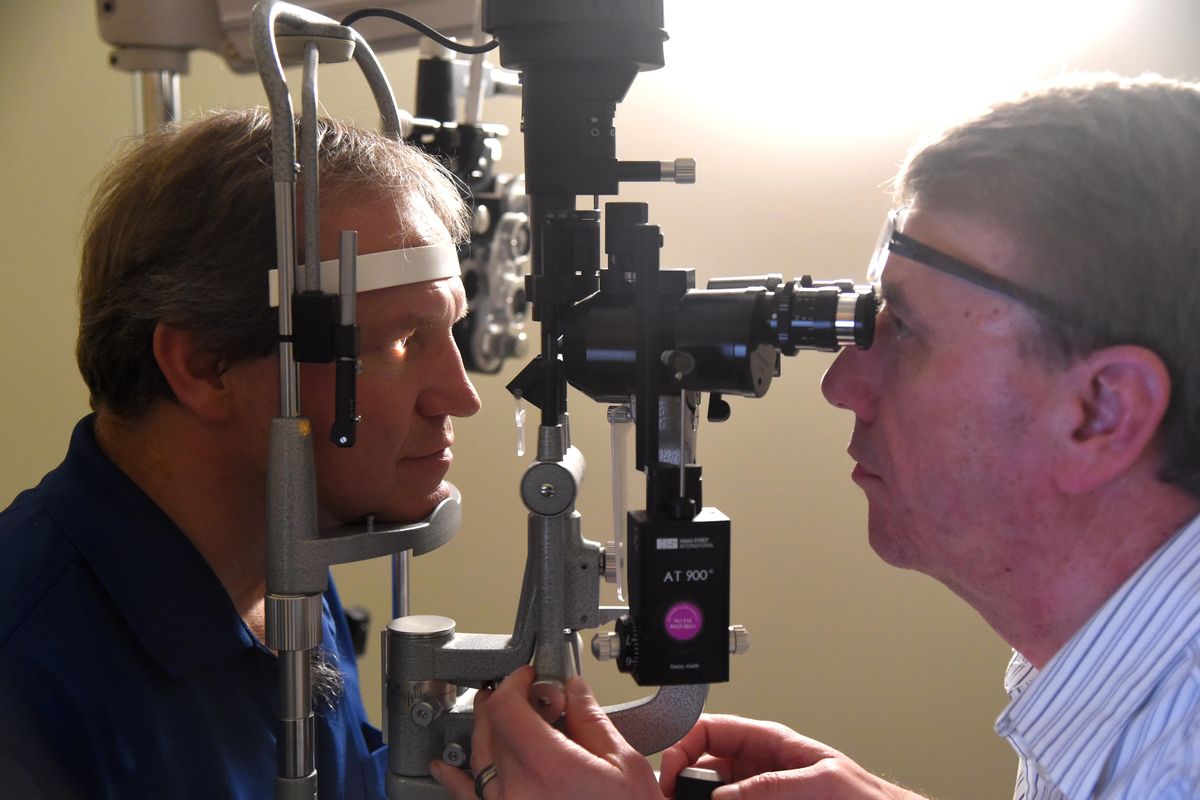

The two organizations share a similar vision and model for providing treatment, with a focus on preventive care for members, Stanford said. That includes “making sure they’re getting their cancer screenings and flu shot. … The ultimate goal is to improve the health of the entire population,” she said.

Group Health and Kaiser already collaborate in a number of areas, Stanford added. Reciprocal agreements allow patients to be seen at the other organization’s facilities when they’re traveling. Doctors, nurses and other health professionals from both organizations also attend training together.

“There’s a lot of sharing around best (medical) practices,” Stanford said. “We’ve done that for a long time.”

The deal is subject to approval by Group Health’s voting membership and by regulators, including the Washington state insurance commissioner and federal authorities.

The two organizations have finalized an agreement for the Kaiser Foundation Health Plan to acquire Group Health, part of a wave of hospital-system and health-insurance mergers nationwide.

In exchange for Group Health, with 600,000 members and annual revenue of $3.5 billion, Kaiser Permanente is contributing $1.8 billion to set up a new Group Health Community Foundation, Armstrong said.

In addition, Kaiser plans to invest an estimated $1 billion during the next decade in new facilities, staff, technology and research in Washington state, said Bernard Tyson, chairman and chief executive of the Kaiser Foundation Health Plan and Hospitals.

Nationwide, regulators have expressed concerns that marketplace mergers may limit choices and drive up costs for consumers, issues echoed by state Insurance Commissioner Mike Kreidler, who promised to review the deal “very closely.”

“My chief concern is protecting consumers in Washington. This proposal requires my approval. My job is to ensure that the proposal benefits policyholders at Group Health and all consumers buying health insurance in Washington,” he said. “I want to ensure that we maintain the healthy competition and wide selection of plans we currently have in our state.”

It could take up to a year to finalize the move, which has been under discussion for about six months, said Armstrong and Susan Byington, chairwoman of Group Health Cooperative’s board of trustees.

Armstrong, who earns more than $2 million a year, said he expects to stay on, and is “very confident” the acquisition will be approved.

Group Health, which faced cuts of $250 million in 2012, has regained a solid financial position and is moving forward with the acquisition out of a position of strength, not weakness, Armstrong said.

The acquisition is supported by Tarnoff, who leads the physicians group, which includes about 1,400 doctors and other health-care providers in the Northwest. The group contracts with Group Health Cooperative to offer care.

Based in Oakland, California, Kaiser Permanente has $60 billion in annual revenue and about 10.3 million members in seven regions, including Colorado, Georgia, Hawaii, the mid-Atlantic states, Northern California, Southern California and the Northwest, including Oregon and parts of southwest Washington. The Group Health acquisition will form Kaiser’s eighth region and boost enrollment to nearly 11 million.

Joining an organization that has national reach, but allows local control, will help make health care more accessible and affordable for consumers, Tarnoff said.

“For those of you who have counted on Group Health to provide you with amazing physicians and clinical teams, and the coverage for your family needs, you will continue to receive the best care and coverage available,” he said.

Group Health officials planned to notify the organization’s 7,000 employees about the plans Friday morning.

Spokesman-Review staff writer Becky Kramer contributed to this report.