CEO defends Fannie Mae

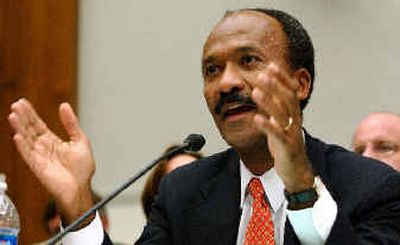

WASHINGTON — Fannie Mae chief executive Franklin Raines defended the embattled mortgage giant’s accounting on Wednesday, disputing regulators’ allegations of earnings manipulation in hours of grueling testimony to Congress.

Raines spoke at a House committee hearing in his first public appearance since an accounting crisis at Fannie Mae became known Sept. 22, amid news of a Securities and Exchange Commission inquiry. Testifying under oath, Raines and chief financial officer Timothy Howard insisted that the regulators’ allegations of accounting improprieties and management misdeeds represent an arguable interpretation of complex rules.

Raines said his company “looked for the facts” in the regulators’ report of their investigation but had found none. “None, other than their calculations that say if you subtract one number from another you get this result,” he said.

Lawmakers closely questioned Raines about an instance in 1998 in which accounting rules were said to have been deliberately violated so that top executives at the government-sponsored company could collect full bonuses.

“This is a very serious allegation and I deny that it occurred,” Raines said.

The bonuses were tied to an earnings-per-share target of $3.23 for Fannie Mae stock that year — and company profits came within pennies of that goal.

The former Fannie Mae accountant who raised questions about the company’s calculations, meanwhile, said he took his concerns directly to Raines and Howard back in 2002 and asked them to investigate. He described a culture of intimidation at the company in which dissenting opinions are suppressed and said he faced retaliation for having spoken.

The regulators in the Office of Federal Housing Enterprise Oversight have said that information provided by Roger Barnes, a manager in the Controller’s Division who left Fannie Mae in October 2003, was important to their investigation of the company’s accounting.

Fannie Mae and Freddie Mac wield influence on Capitol Hill and are heavy contributors to lawmakers of both parties. Democrats, who have staunchly defended the companies against Republican attempts at tighter government regulation of them, turned their criticism Wednesday against regulators who alleged accounting misdeeds at Fannie Mae.

Shares of Fannie Mae, which finances one of every five home loans in America, have lost some $14 billion in value since the allegations of accounting improprieties became known. They rose $1.45 to close at $67.45 Wednesday on the New York Stock Exchange. The shares have fallen about $10 in the past month.

The Washington-based company, which is the second-largest financial institution in the country behind Citigroup, is also facing a criminal investigation by the Justice Department.