Alltel makes $4.4 billion bid

LITTLE ROCK — Cellular giant Alltel Corp. said Monday it is buying Western Wireless Corp. in a $4.4 billion cash and stock deal expected to make it the fifth-largest U.S. wireless company.

The deal, which shifts the Cellular One brand to Alltel, is the latest example of the Arkansas-based company’s strategy of building market share through less populated parts of the nation. Bellevue, Wash.-based Western Wireless has about 1.4 million U.S. wireless customers in 19 western and midwestern states that are contiguous to Alltel’s existing properties, which are chiefly in the South and West.

Should the acquisition be approved by shareholders, the Little Rock-based company would have $10 billion in overall revenue and coverage of a vast share of the rural United States with 10 million wireless customers in 33 states.

The purchase would also give Alltel an international component. Western Wireless has 1.6 million customers in six foreign countries, most of them in Austria and Ireland.

In trading Monday, Western Wireless shares surged 85 cents, or 2.3 percent, to close at $37.37 on the Nasdaq Stock Market — a new 52-week high, but well below the $39-$40 per share range at which analysts pegged the deal.

Alltel shares slipped $1.37, or 2.4 percent, to finish at $54.75 on the New York Stock Exchange. The stock has traded in a 52-week trading range of $47.25 to $60.62.

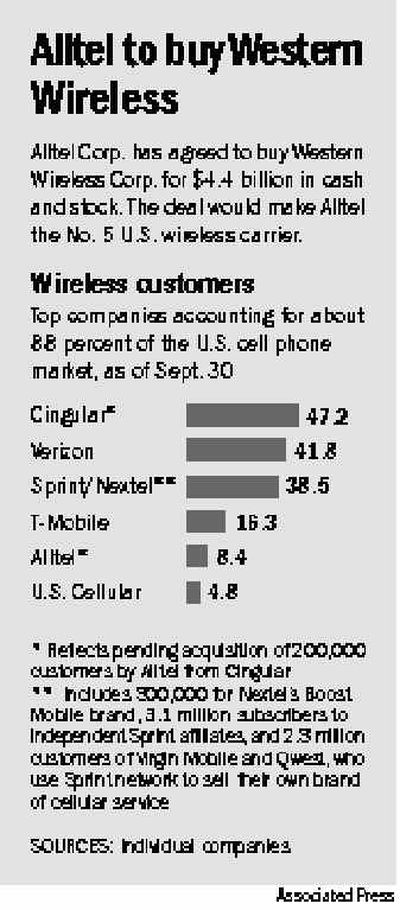

The deal marks the latest consolidation in the competitive wireless phone service industry.

Last month, Sprint Corp. agreed to buy Nextel Communications Inc., the fifth biggest U.S. wireless provider, for $35 billion in an agreement that would fortify Sprint’s position as the nation’s third largest wireless service provider behind Cingular Wireless and Verizon Wireless.

A Sprint-Nextel combination would have 35 million wireless subscribers and a combined $40 billion in annual revenue.

Rick Black, an analyst with Blaylock & Partners L.P., said the purchase of Western Wireless should help Alltel protect its wireless position, as well as its business as a provider of roaming services to other national wireless carriers.

He also said the agreement, which values Western Wireless shares at about $40, could be a harbinger of more deals to come.

“Although the proposed acquisition does little to change the wireless hierarchy, it does shift the balance of power as Alltel gain market share in overlapping areas and becomes a significant roaming partner to all national players,” he wrote in a research note. “We expect more rural wireless M&A activity.”

Alltel, currently the nation’s No. 6 cellular provider, said it would issue 60 million shares, which were worth about $3.4 billion at Friday’s closing price, and pay $1 billion in cash for Western Wireless’ shares under terms of the deal.

Alltel will exchange 0.535 shares of Alltel stock plus $9.25 in cash for each Western share. Western shareholders will have an option for all cash or all stock.

Alltel is also assuming about $1.5 billion in debt in the deal.

Alltel said the purchase would give it coverage over one-fourth of the United States’ population.