Options scandal endures

WASHINGTON — Eighteen CEOs swept out. More than a hundred public companies under federal investigation and over $5 billion in profits erased by restatements. Indictments so far: five former top executives at two companies, Brocade Communications Systems Inc. and Comverse Technology Inc.

The toll of the stock options timing affair — corporate America’s scandal of the year — has been heavy. Federal officials say more prosecutions will be brought in 2007 over manipulation of the timing of stock option grants to enrich top company executives.

Nearly every business day, more companies report federal or internal investigations. New lawsuits by shareholders are filed. More businesses disclose that because past option grants may have distorted their financial results, they may have to restate earnings. Next year could well bring more restatements, and companies’ stock could be stripped from public trading because reviews of options grants made them late in filing their quarterly financial reports.

The Justice Department will “continue to be engaged for perhaps years to come, as we work these cases out,” U.S. Attorney Kevin Ryan, who heads a task force in northern California pursuing options timing cases, said recently at a gathering of attorneys. “The final chapter hasn’t been written yet.”

Many of the companies ensnared in the scandal are in Silicon Valley’s high-tech industry, where stock options for employees created legions of millionaires in the dot-com era. The prized perks allow executives and employees to buy shares of their company’s stock in the future at a set price. If the stock rises before the options are exercised, the employee can buy the stock at the predetermined, lower price, then sell it at the higher, current price — and pocket the difference.

Among the wide swath of companies caught up in internal or government investigations: Apple Computer Inc., Barnes & Noble Inc., Caremark Rx Inc., Costco Wholesale Corp., Gap Inc., The Home Depot Inc., McAfee Inc., Monster Worldwide Inc., Restoration Hardware Inc., Staples Inc. and UnitedHealth Group Inc.

Some prominent executives at blue-chip companies have lost their jobs in the affair, including former UnitedHealth CEO William McGuire, who engineered the company’s ascent from a regional health insurer into the nation’s second-largest. A sort of guillotine for corporate executives has been set out in the public square, with the scandal claiming at least 59 senior executives or board directors at 32 companies so far.

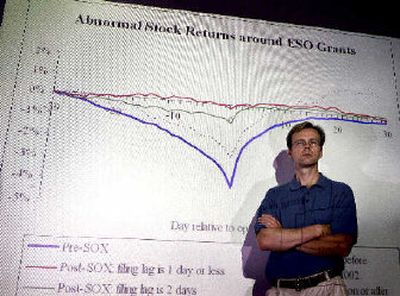

Will there be more? Just over 2,000 public companies, or 29 percent of those in the United States that give stock options to executives, have timing issues, according to Erik Lie, an associate professor of finance at the University of Iowa, and Randall Heron, an Indiana University associate finance professor. Their research last year helped focus attention on a widespread pattern of conduct.

“I suspect the number of companies will continue to grow, but I don’t expect at the end of the day we’re going to see that many enforcement actions” by federal authorities, said Lynn Turner, a former chief accountant of the Securities and Exchange Commission. “You just can’t do something this big with the same amount of resources.”

SEC Chairman Christopher Cox has pledged vigorous pursuit of cases and said recently that new charges will be brought in the near future. The agency is focusing on cases of serious fraud, with elements such as deliberately lying or forging documents. Cox said there have been an “unprecedented” number of companies that have voluntarily reported irregularities — cooperation that will be taken into account in determining sanctions. Ryan, too, said: “We’re trying to drill down on them and prioritize.”

At the same time, the Justice Department on Tuesday eased its tough legal tactics for prosecuting companies, requiring prosecutors to get approval from Washington before seeking confidential information between corporations and their attorneys. Some government officials believe that the existing guidelines, crafted in the aftermath of the corporate scandals that included Enron Corp. and WorldCom Inc., may have led prosecutors to overreach when targeting some companies and pressuring them to cooperate in investigations of wrongdoing by executives.

Shareholders were hurt by an average loss in market value of 8 percent, or $500 million, for each affected company from the negative publicity of being under government investigation, researchers at the University of Michigan found in a study.