Earnings roundup : Boeing’s profits soar

Boeing Co. put more pressure on its European rival Airbus Wednesday in the dogfight for the slot as the world’s No. 1 airplane maker.

Boeing reported a 27 percent boost in first-quarter earnings that beat Wall Street projections, while its backlog surged to another record level. Meanwhile, its revenue grew 8 percent.

“Boeing is gaining market share and doing it very profitably. That’s a tough competitor,” said Richard Aboulafia, an airline analyst with Teal Group. “Usually, it’s a choice: market share or profit. To be able to do both at this rate is a serious threat for Airbus.”

Earlier this year, Boeing surpassed Airbus in plane orders, but the European company delivered more aircraft and held its position as the world’s top airplane manufacturer. Boeing is expected to outpace Airbus’ deliveries next year.

Chicago-based Boeing earned $877 million, or $1.13 per share, in the quarter ended March 31, compared with $692 million, or 88 cents per share, a year earlier.

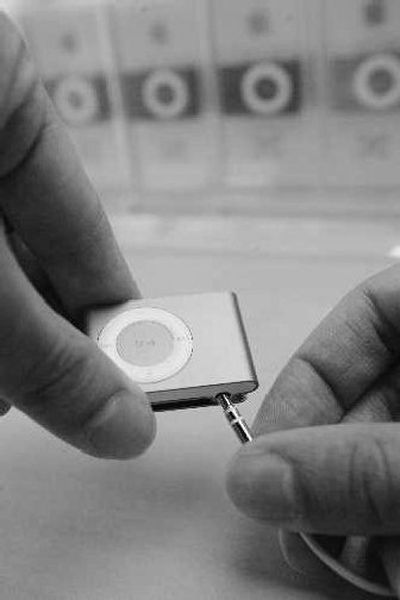

“Apple Inc. blew past Wall Street expectations Wednesday, posting quarterly profits that jumped by 88 percent, fueled by strong sales of its iPod players and Macintosh computers.

In the first three months of the year, the Cupertino-based company said it earned $770 million, or 87 cents per share, up from $410 million, or 47 cents per share, in the year-ago period.

Sales were $5.26 billion, up 21 percent from $4.36 billion last year.

Analysts, on average, were looking for earnings of 64 cents per share on sales of $5.17 billion, according to a poll by Thomson Financial.

“ConocoPhillips said Wednesday that asset sales pushed its first-quarter profits up 7.7 percent, but the oil major’s key exploration and production arm was hurt by lower commodity prices and the company warned of lower production.

Net income for the Houston-based company rose to $3.55 billion, or $2.12 a share, for the January-March period, from $3.29 billion, or $2.34 a share, in the year-ago quarter.

ConocoPhillips said its profit included a one-time net benefit of 29 cents a share from the sale of assets.

Revenue fell 12 percent to $41.3 billion from $46.9 billion a year ago.

ConocoPhillips is the second major oil company to report earnings in as many days. BP PLC, Europe’s second-largest oil company, on Tuesday reported a 17 percent drop in first-quarter earnings on lower oil prices and declining production. Exxon Mobil Corp., the world’s largest publicly traded oil company, reports first-quarter results Thursday.

“United Airlines’ parent company posted a bigger-than-expected $152 million loss for the first quarter Wednesday, pressured by the reduced domestic passenger demand that has slowed results for U.S. carriers.

UAL Corp. said it added too many flights in January during a slow travel season and was hurt by the storms that crippled flying schedules in February. Its executives said they might reduce U.S. capacity later this year among possible moves to cut costs further and raise revenue.

It was the company’s second quarterly deficit in a row, just a year after its emergence from bankruptcy, and investors and analysts showed their disappointment despite United’s improvement from last year’s first quarter.

UAL shares, already down 12 percent in the past week on signs of weaker domestic results, fell another 88 cents, or 2.2 percent, to $38.28 Wednesday on the Nasdaq Stock Market.

“PepsiCo Inc., the world’s second-largest soft drink maker, said Wednesday its first-quarter profit rose 16 percent on the strength of its international and Frito-Lay snacks divisions.

Chief Executive Indra Nooyi said the company had a “rich acquisition pipeline” and that investors could expect the company to do deals worth as little as $5 million to $10 million and as much as $2 billion.

PepsiCo has recently made acquisitions to diversify its holdings of snacks and non-cola drinks seen as healthier alternatives.

Profit for the quarter ending March 24 was $1.1 billion, or 65 cents per share, up from $947 million, or 56 cents per share, a year earlier.

Revenue rose 9 percent to $7.35 billion from $6.72 billion last year.

“UPS Inc., the world’s largest shipping carrier, reported a 13.5 percent decrease in first-quarter profit Wednesday amid slower economic growth and after it incurred charges for shedding fuel-hogging Boeing 727s and 747s.

Excluding the charges, the Atlanta-based company met Wall Street expectations and saw sales rise 3.3 percent.

Earnings dropped to $843 million, or 78 cents per share, for the three months ended March 31, from $975 million, or 89 cents per share, in the same period a year ago.

“Pricier beer, fewer discounts and another strong showing overseas offset sluggish U.S. beer sales for Anheuser-Busch Cos. Inc., with the nation’s largest brewer reporting a 3.7 percent increase in first-quarter earnings.

The maker of Budweiser, Bud Light and other beers reported a profit of $518 million, or 67 cents per share, in the period ending March 31, up from $499 million, or 64 cents per share, in the first quarter of 2006.

Net revenue for the St. Louis-based company rose 2.7 percent to $3.86 billion.