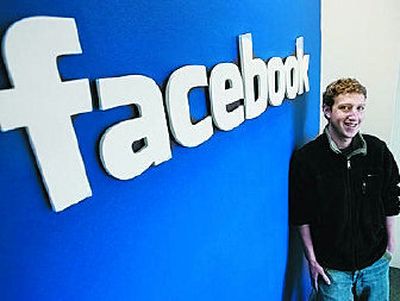

The face of opportunity

PALO ALTO, Calif. — As Facebook.com’s mastermind, Mark Zuckerberg is sitting on a potential gold mine that could make him the next Silicon Valley whiz kid to strike it rich.

But the 22-year-old founder of the Internet’s second largest social-networking site also could turn into the next poster boy for missed opportunities if he waits too long to cash in on Facebook Inc., which is expected to generate revenue of more than $100 million this year. The bright outlook is one reason Zuckerberg felt justified spurning several takeover bids last year, including a $1 billion offer from Yahoo Inc.

“We clearly have a bias toward building,” Zuckerberg said. “We think there is a lot more to unlock here.”

The build-or-sell dilemma facing Zuckerberg has become more common among entrepreneurs in the latest Internet craze, a communal concept of content-sharing dubbed “Web 2.0.”

Besides Facebook, other Web 2.0 startups frequently mentioned as prime targets include video site Metacafe Inc. and Photobucket Inc., which has emerged as one of the Internet’s busiest places for hosting personal videos and photos.

These sites find themselves at a critical juncture reached several years ago by the Internet’s first big social-networking site, Friendster.com, which chose to stay independent instead of selling. That decision is now regarded as one of Silicon Valley’s biggest blunders.

News Corp. paid $580 million in 2005 to buy MySpace, the largest social-networking site, and Google Inc. snapped up video-sharing pioneer YouTube Inc. for $1.76 billion late last year.

“I’m surprised a lot more companies haven’t already been bought,” said Reid Hoffman, a veteran Silicon Valley executive who has invested in many startups, including Facebook. “My hunch is the deals are only going to get more expensive in 2008 and 2009.”

If the deal-making market continues to heat up, Zuckerberg will end up looking smart for rebuffing Yahoo and other suitors, including Microsoft.

A Facebook sale or IPO is bound to happen eventually so the startup’s early investors can realize some profits. Facebook has raised about $38.5 million since Zuckerberg started the site in 2004 while he was still a sophomore at Harvard University.

An IPO or sale will “make sense at some point for the company, but I never think that’s the goal,” said Zuckerberg, who is believed to control nearly one-third of Facebook’s stock. “The goal is to … continue introducing certain revolutionary products that push us to the next level.”

Should Facebook stumble, it may some day be suffering the same pangs of regret tormenting Friendster Inc., which turned down a takeover bid from Google in 2003.

Had that offer been accepted, Friendster founder Jonathan Abrams and early investors reportedly would have received $30 million in Google stock now worth about $1 billion.

Abrams left Friendster in 2004 after a falling-out with the company’s venture capitalists. Now working on its fourth chief executive since Abrams’ departure, Friendster hasn’t recaptured the buzz that made it a prized property at one time.

Other tales of woe are bound to emerge after the latest deal-making cycle winds down, predicted Ken Marlin, a technology investment banker in New York.

“The world is filled with companies that waited too long to sell and missed their window of opportunity,” he said. “We think this land grab (on the Internet) probably will only last another year or two.”

Currently, no startup is stirring more takeover chatter than Facebook, which began as a site exclusively for college students before opening up to high school students in 2005 and finally accepting all comers last fall.

The site now has nearly 17 million registered users, most of whom fall into the under-35 demographic prized by advertisers. Facebook struck its first major financial partnership last summer with Microsoft, which reportedly guaranteed to deliver about $200 million in ad revenue through 2008.

Although he dropped out of Harvard in 2004 to move Facebook to Silicon Valley, Zuckerberg still leads the ascetic lifestyle of a college student even as he runs a business with 200 employees.

Zuckerberg says he keeps little more than a mattress in his apartment, which is located just a few blocks away from Facebook’s office. The proximity allows him to walk to work every day, usually wearing Adidas sandals ideally suited for lounging around a campus dorm.