Encouraging signals

Rhetoric aside, economy shows signs of recovery

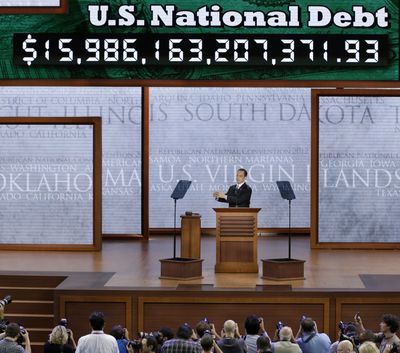

WASHINGTON – You wouldn’t know it from listening to the Republican National Convention, but the nation’s economic picture seems to be slowly getting a little brighter.

Not a lot, and not very fast. Yet there are some glimmers.

Nationally, the recent gains are modest and won’t do much to push the unemployment rate down much below its present 8.3 percent level before the Nov. 6 presidential election.

But economists cite some encouraging new data:

• The government reported Thursday that Americans spent at the fastest pace in five months in July, and personal income rose as well.

• Home prices rose in the first half of 2012 for the first time in nearly two years. Sales of both new and previously occupied homes also are up.

• Employers added 163,000 jobs in July, the most since February.

• U.S. exports, retail spending and factory production are all up.

Yet phrases such as “catastrophic debt,” “stifling the American dream,” “the tide of decline” and “an all-out assault on free enterprise” fill the air in the convention arena.

The rhetoric fits the GOP strategy of portraying President Barack Obama as out of touch and pursuing policies that have made the economy worse, not better, while Republican presidential nominee Mitt Romney is presented as the one with the business experience and savvy to turn things around.

Democrats get their turn for rebuttal next week at their own convention in Charlotte, N.C. But there are risks to sounding too optimistic on the economy.

Obama has been relatively cautious – welcoming recent positive reports but warning there’s still a long road to a full recovery.

A report released Tuesday showed the U.S. economy grew at a 1.7 percent annual rate from April to June – an upward revision from the initial 1.5 percent estimate but still signaling continued sluggishness.

Gasoline prices have been rising again toward $4 a gallon. Concerns remain over debt problems in Europe and a slowdown in China. And despite improving U.S. job and housing markets, consumer confidence is at its lowest level since November 2011.

Nigel Gault, chief U.S. economist at IHS Global Insight, said “housing is the area where you’ve got the most positives,” and that’s extremely important since housing weaknesses were a central cause of the downturn.

“We are at the start of a long prolonged recovery in the housing market. We’re not bouncing along the bottom anymore,” Gault said. “But there’s still a long list of other reasons for businesses and consumers to be cautious.”

“There’s not much to gloat about,” said Robert Shapiro, a former undersecretary of commerce in the Clinton administration who now advises Democrats and runs an economic consulting firm.

But things aren’t as bad as Republicans portray, he said. “There is a recovery. We’ve been in a recovery in fact for over two years. It’s an unusually slow recovery but it is a recovery.”