Voice of experience

Business success, expertise pay off for Laurie Roth

Some people flip houses.

Laurie Roth flipped a restaurant.

After years of telling others how to run their businesses, “I decided it was time to walk the talk,” she said. “So I started making cash offers on all sorts of failing companies. The one I ended up buying was an Italian restaurant.”

The first night, Roth and her six employees served one customer.

“I thought, ‘What have I done?’ But I stuck to my plan, and within six months there was a line out the door.”

Two years later, she added a catering company, and after five years sold the business for a substantial profit.

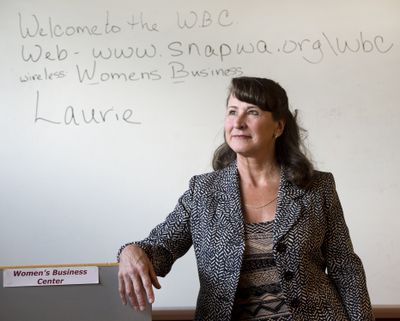

Roth’s peripatetic career eventually brought her to Spokane, where a year ago she launched SNAP’s Women’s Business Center.

Based on her 30 years of work in the lending industry, Roth recently was named the U.S. Small Business Administration’s 2015 Women in Business Advocate for Washington.

During a recent interview, she described her first business venture, how to identify a company worth buying, and why denying someone a loan is doing them a favor.

S-R: Where did you grow up?

Roth: On a farm in western Nebraska. The closest town was Rapid City, South Dakota, about three and a half hours north.

S-R: Did you have a favorite class or activity in high school?

Roth: They called me “miss everything,” because I was an honor student, a cheerleader, and I did drama, band and chorus. But my favorite thing was athletics. I still hold some school track records.

S-R: What was your ambition back then?

Roth: To get off the farm and go to college, because no one in my family had ever been. I went to Kearney State College on a scholarship, but dropped out after my sophomore year and moved to California.

S-R: What did you do there?

Roth: I got a night job at a real estate school, and within a year and a half was managing it. Once I had my California residency, I earned a degree from San Jose State.

S-R: What was your next career?

Roth: I wanted to go into advertising because I’d watched “Bewitched” growing up, and Darrin Stephens seemed to have fun doing the advertising thing. But during a six-month internship, I discovered advertising wasn’t a good fit. So I moved on to selling computerized accounting systems to TV stations. That was a great job – six weeks on, two weeks off. But then our paychecks started bouncing, so I switched to finance, and later bought and sold the restaurant and another business.

S-R: What brought you to Spokane in 2014?

Roth: SNAP received a Small Business Administration grant to start a women’s business center, and hired me to launch it. After it was up and running, I turned it over to another employee. Now I teach classes there and offer one-on-one counseling while I relaunch the consulting business – SBA SOS – that I put on hold when I moved here.

S-R: Looking back over the past three decades, what memories stick out?

Roth: One of my worst memories from my early banking days was putting together a deal I thought was excellent. When I took it to my boss, the first thing he did was turn to the balance sheet, then threw the file at me and said, “Never walk in here again with a business that has a negative net worth.” That’s when I realized I was in way over my head. So I went through all the lending certification programs and got my skills up. Luckily, I knew more about computers than most people back then, and that gave me a big advantage. One thing I teach all my clients now is that technology is a great equalizer for small businesses.

S-R: You’ve done everything from buy businesses to lead cheers. What basic skill has proved most valuable, and where did you learn it?

Roth: My dad taught me to leverage my resources. On my sixth birthday, I asked for a female pig. And I wrote a contract that said when she had babies, I got to keep two, my dad got the rest, and I would help him raise them. Every year for the next seven years, I would take two pigs to market. That’s how I was able to buy my first horse.

S-R: You said sometimes the best thing you can do for aspiring entrepreneurs is decline their loan application. Can you explain?

Roth: Everything might look good on paper, but as you go through the due diligence, you see reasons why they’re not ready. Part of my job is warning people if they have a model that won’t work. If they find someone else willing to approve their loan, they might end up bankrupt in seven or eight months.

S-R: What do you like most about your job?

Roth: Seeing people succeed.

S-R: What do you like least?

Roth: Trying to coach people who shouldn’t even consider starting a business. Some can’t find a job, they’re chronically unemployed, and they think starting a business is an easy way to make money. It’s not.

S-R: What other misconceptions do you encounter?

Roth: People think there are grants to help them buy small businesses. There aren’t. There are loans. You need 30 to 50 percent down, and you have to pay the loan back. But you can borrow as much as $5 million from the SBA, and this is a great time to get financing.

S-R: Any big surprises during your career?

Roth: When I owned the restaurant, I did a lot of guerilla marketing. I’d take samples of my desserts to local radio stations, and before I even pulled out of the parking lot, the DJs would be talking up my restaurant on the air. But the biggest surprise was the response after I was featured on the cover of the Sacramento Bee food section. Suddenly I had a line out of my door.

S-R: What appealed to you about the restaurant business?

Roth: I wasn’t looking for a restaurant. I made offers on several failing companies, because businesses have a life cycle – if they don’t reinvent and enlarge, they decline. I was looking for any established business that was in decline, was owned by its founder and had a lot of low-hanging fruit. The restaurant had everything.

S-R: What advice would you offer someone looking to buy a business?

Roth: Get a list of people who have been in business 25 years, and start calling them. Ask them if they’ve thought about selling. Find people’s pain – someone eager to retire. And offer cash, if you can. That makes all the difference.

S-R: Are some business sectors more appealing than others today?

Roth: Anything brick and mortar is tough because of the huge overhead. Service industries like my consulting business have no overhead, so my $125 an hour goes straight into the bank. You have to do a lot of work in a restaurant to drive $125 to your bottom line.

S-R: What services does SBA SOS offer?

Roth: I coach start-up companies about concepts designed to save them time and money when they launch their business. Once the business is established, I counsel them on getting things like the Women Owned Small Business certification, which is hugely important.

S-R: What earned you the SBA award?

Roth: I was nominated by Mary Kendall, who is with the SBA here. But the award was based on my 30 years of SBA experience.

S-R: Did it come with a cash prize?

Roth: (laugh) SBA has a no-frills budget. They can’t even buy donuts. But I did get a nice trophy.