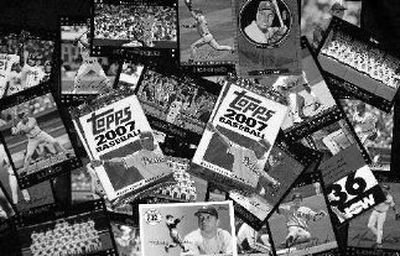

Cards are on the table

NEW YORK — The Topps Co., maker of baseball cards and Bazooka bubble gum, said Tuesday it accepted a $385.4 million takeover offer from a buyout group that includes former Disney CEO Michael Eisner, but the deal drew immediate opposition from one of its own board members.

Topps director Arnaud Ajdler, along with the investment firm Crescendo Partners II, launched a campaign to kill the deal. Crescendo owns about 6.6 percent of the company’s shares, according to filings with the Securities and Exchange Commission. Ajdler is also a managing partner of Crescendo.

Ajdler said Tuesday he had not yet been in touch with other major shareholders but he thought the deal should be abandoned because negotiations did not go through a proper process and that the Eisner-led offer undervalues the company.

“I believe that the process that led to the signing of the merger agreement was flawed in that the board of directors did not shop the company and thus failed to maximize the competitive dynamics of a sale transaction that would have garnered the highest price available,” Ajdler wrote in a letter sent to board members on Tuesday.

The deal was approved in a 7-3 vote by the board with Ajdler and two others voting against the deal. Ajdler was joined by Timothy Brog, president of Pembridge Capital Management LLP, and another board member John Jones. Pembridge had earlier pressed the company to solicit acquisition proposals.

The buyout group, which includes The Tornante Co. LLC, founded by Eisner, and the Chicago-based private equity firm Madison Dearborn Partners LLC, has agreed to pay $9.75 for each Topps shares, which represents a premium of 9.4 percent over the stock’s Monday closing pricing of $8.91 on the Nasdaq Stock Exchange.

In a sign that some investors think the bidding could go higher, Topps shares rose 90 cents, or 10 percent, to close at $9.81 on the Nasdaq Stock Market. Its shares have traded between $7.50 and $10 over the past 52 weeks.

The company said in its announcement that it will solicit better offers over the next 40 days.

The deal requires regulatory approval and a vote by Topps shareholders, but the company said it could close by the third quarter.