Writing is on the wall

OMAHA, Neb. – Richard Kesterson slid his debit card out of his wallet even before the cashier at a Hy-Vee grocery store in west Omaha rang up his total.

Kesterson, like millions of other Americans, didn’t even consider paying by check. Using a debit card is easier, he said.

Kesterson also eschews checks when paying his bills in favor of online bill pay, and then lets his bank keep track of his spending.

“I haven’t balanced my account in 10 years,” Kesterson said.

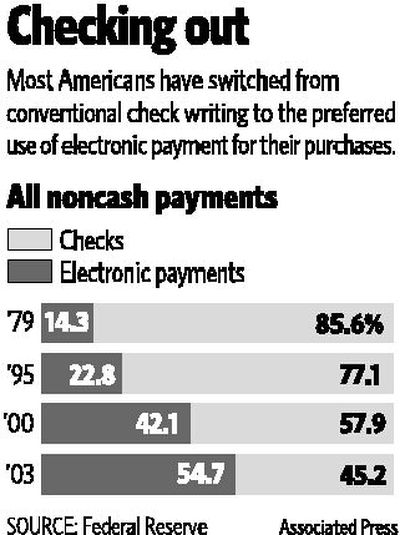

Such habits are part of the reason why check writing has declined sharply since 1995. The Federal Reserve estimates that 49.5 billion checks were paid in the United States in 1995; that figure dropped to 36.6 billion checks paid in 2003, according to the most recent Fed studies. Increasingly, some checks are even being converted into electronic payments by merchants, who prefer electronic transfers to handling paper checks.

The widespread availability of debit cards and the growing popularity of plastic are the biggest factors in the decline. Between 2000 and 2003, the number of debit card transactions nearly doubled from 8.3 billion to 15.6 billion, and the number of credit card transactions jumped from 15.6 billion to 19 billion.

Julie O’Neill of Omaha said she thinks her credit card is more convenient than writing a check, and all her spending is compiled on one statement at the end of the month.

When it comes time to pay bills, O’Neill turns to her computer instead of her checkbook because she can pay her bills at the last minute.

“I procrastinate, so then I can go online and not have to go through snail mail” to pay bills, O’Neill said.

Together, credit and debit card use accounted for 43 percent of all non-cash payments in 2003, up from 33 percent in 2000.

In some cases, consumers may still write a check, but increasingly, merchants are scanning those checks and converting them into an electronic payment. So the Federal Reserve counts those checks as electronic payments and not as checks; paychecks electronically deposited in employees’ bank accounts are also included in this category.

Converting checks to electronic payments allows merchants to get paid quicker, and it may help reduce the number of insufficient funds checks businesses have to deal with. Processing checks electronically is also cheaper than processing paper checks.

In 2003, about 8.9 billion converted checks were reported, accounting for about 11 percent of all non-cash payments.

At some stores that process checks electronically, such as Wal-Mart Stores Inc. and Gap Inc. clothing retailers the Gap and Banana Republic, the clerk hands the check back to the consumer with their receipt after scanning it and claiming an electronic payment for the store.

Consumers may not realize that many of the checks they write to utilities, mortgage companies and other businesses are also being converted to electronic payments when those companies receive the checks, said Terri Bradford, a payments researcher with the Federal Reserve Bank of Kansas City.

The decline in check writing, combined with the increase in electronic check processing, prompted the Federal Reserve to dramatically reduce the size of its check-processing department, whose operations are covered by the processing fees it charges for handling checks and electronic transfers. Since 2003, the Fed has closed more than half of its 45 check processing centers, and by the end of 2008, only 18 such centers will remain operational.

Demographics are part of the reason why checks continue to be used, because older consumers are comfortable with what they’ve used for years. And Bradford said there are still some transactions checks are better suited for, such as paying the neighbor kid who mowed the lawn or making a contribution to the church, to have a record of charitable donations at tax time.

Joe Abboud wrote a check for his groceries at Hy-Vee recently because that’s what he always does.

“I write a lot of checks,” he said.

Abboud will occasionally use a credit card, but the 90-year-old is just more comfortable with checks.

Another grocery customer, Cheryl Carlson, said she usually writes checks to help keep track of her spending. When she writes a check, she always writes the amount down in her register, but she sometimes forgets that step with her debit card.

“The only time I use my debit card is when I leave the checkbook at home,” said Carlson, who is in her 40s.

Bradford, the payments expert, said checks might remain popular for transactions when the payment must be guaranteed, such as at real estate closings, especially when individuals and small businesses are involved.

Wire transfers could also be used to guarantee payment, but Bradford said those transfers can be costly for people who don’t use them often.

Some business payments might also be better suited to checks rather than electronic payments, Bradford said. Writing a check instead of authorizing a wire transfer or making some other electronic payment may help a business better manage its cash flow because there is still some delay between when the check is written and when it is received.

“From a cash management purpose, I imagine some businesses would still prefer checks because of the float,” Bradford said.

Bradford said there’s no way to predict how quickly check writing will continue to be replaced by electronic payments. About 26 percent fewer checks were paid in 2003 than in 1995.

But she doesn’t expect checks to entirely vanish.

“There’s a certain segment of the population that’s going to write checks,” Bradford said. “You probably get stuck behind them in the check-out aisle.”