Earnings Roundup: Weyerhaeuser feeling heat of housing slump

Weyerhaeuser Co., one of the world’s largest lumber and packaging producers, said Wednesday its third-quarter profit dropped 55 percent as weakness in the housing construction market hurt its wood products and real estate businesses.

But excluding one-time items, the results beat Wall Street expectations, sending shares higher even as the company said it expects market conditions to remain challenging.

Despite forecasting some difficult quarters ahead, chief executive Steven Rogel said the company is well positioned to benefit significantly when the housing market eventually recovers.

“We remain bullish on the housing market,” Rogel said in a conference call with analysts and reporters. “As we’ve discussed before, the long-term demographic trends support not only a rebound from today’s levels but a strong housing market for the long term.”

NightHawk Radiology Holdings Inc. of Coeur d’Alene reported third-quarter income of $3.8 million, or 12 cents per share, on revenues of $45.2 million.

The results compared to income of $5.6 million, or 18 cents per share, on revenues of $25.2 million for the third quarter of 2006.

Dr. Paul Berger, NightHawk’s chairman and CEO, attributed the lower income to costs associated with several acquisitions.

Company officials issued new guidance for NightHawk’s 2007 revenue. Instead of revenues in the $155 million to $162 million range, NightHawk is now anticipating income in the $152 million to $155 million range.

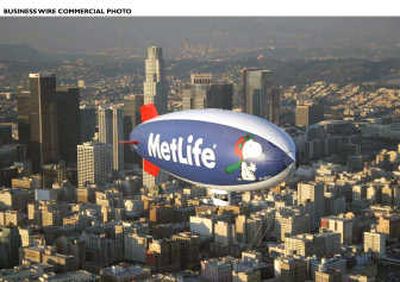

MetLife Inc.‘s profits edged lower in the third quarter as the No. 1 U.S. life insurer suffered $270 million in losses from investments used to hedge its insurance portfolio.

Quarterly profit after paying preferred dividends fell to $985 million, or $1.29 per share, from $999 million, or $1.29 per share, in the same period a year earlier. MetLife had more shares outstanding in the year-ago period.

Operating earnings, which strips out investment losses, rose to $1.52 per share from $1.24 per share for the year-earlier quarter. Revenue rose to $13.06 billion from $12.53 billion in the year-ago period.

Like most insurers, MetLife parks the premiums it collects in investments like stocks and bonds. As investments tied to the value of mortgage debt plunged, there had been concern about how much exposure MetLife had in its $333.4 billion investment portfolio.

MasterCard Inc.‘s third-quarter profit blew past Wall Street’s expectations, jumping 63 percent in a powerful reminder that many people around the world are still making money and finding ways to spend it.

The credit-card processor’s results – boosted by sharp increases in spending overseas and moderate growth in the United States – drove shares up more than 20 percent Wednesday to an all-time high.

In these rocky times for the financial sector, MasterCard plays a desirable role: Processing the world’s credit card payments but taking on none of the debt.